Market Review

While many commonly suggest that CTAs have trouble in periods without trend, we recognize that this is a challenge for most strategies and not a very good explanation. Throughout Q2 and much of 2012, the market has been highlighted by choppy volatility, central bank interventions, and sharp reversals which are indeed difficult times for most managed futures strategies. In these periods it is often a good result to gain sideways performance and modest pullbacks which are a reality and trade-off in producing non-correlated performance.

Since equity markets moved lower starting in March/April and continued sharply lower in May, the diversification benefits of Managed Futures added value and a measure of reassurance in an otherwise volatile environment. While a negative period of performance does not feel good, it needs to be taken in the context of the overall portfolio and the gains made across all assets. If you consider the market still at risk and/or are looking for non-correlated diversification, this may be an entry point to consider.

Index Review

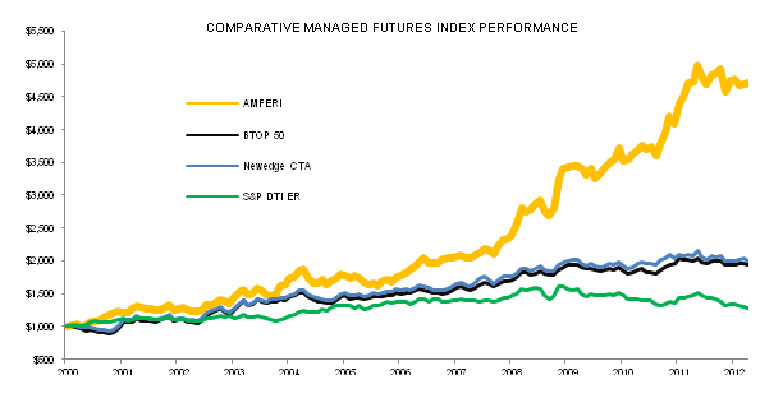

The AMFERI was down 0.55% during Q2 and is -1.90% YTD after gaining 8.48% in 2011. By comparison, the S&P DTI (Diversified Trends Indicator Price Return) lost 6.24% during the quarter and -10.24% YTD.

Portfolio Recap:

In Q2, the AMFERI index was profitable in 2 of the 4 sectors, negative in 2 and flat in 1. The weakest sector within the index was Energy which started to soften significantly at the end of Q2. Currencies also remained a challenge. Sector gains were made in Agricultures led by weakness in Softs and long Interest Rates. Metals were flat on the quarter.

The index is currently positioned defensively, tilted short in 9 of 12 commodity markets, protecting from downside in many commodities. It is also short 4 of the 9 financial markets all within the currency sector. Interest rates remain long. In total 13 of 21 markets are short.

Energy

While the index added long positions in Crude Oil, Heating Oil and Gasoline in Q4 2011 and early in 2012 which provided gains in Q1, the market softened dramatically in Q2. The index has reversed and gone short in all 3 of those markets. The index remains short Natural Gas since July 2008 despite some of the recent gains. Natural gas has remained in a downtrend since mid 2008. This sector was not profitable in Q2 providing the bulk of the index loss.

Metals

The Metals sector is positioned short. The index was long Silver much of Q2 but has now reversed to be short near the end of June. Copper and Gold continue to trend lower remain a short weight. This sector was not profitable in Q2.

Agriculture

The Ag sector provided gains led by the weakness in Soft Commodities during Q2. Cotton, which was shorted midway through 2011 continued to experience weakness in Q2. Sugar was also weaker during Q2 and was a profitable short exposure. While each of the Grains acted in a unique manner and is treated discretely, all have long weightings at the end of Q2. Soybeans remain long since Q1 while Corn and Wheat flipped from short to long during the quarter. Corn was added at the end of June while Wheat was added at the end of May. Grains were flat on the quarter.

Interest Rates

We remain long interest rate futures across the curve (US 5 and 10 year Notes and 30 year Bonds) although movement higher was modest. This sector was profitable in Q2.

Currencies

Currencies remain very choppy highlighted by short term trend reversals inspired by central bank and policy interventions. While the strategy was profitable holding a short in the Euro and long the US Dollar Index, the other currencies were a challenge. In May, the Aussie and Canadian dollar which had been long and in uptrend reversed and headed lower. The strategy went short Aussie in May and short Canadian dollar in early June. The long British Pound also pulled back heavily where the index remains long. Lastly, our short in Japanese Yen rallied against the trend and moved higher. As such, it was a challenge in currencies but we have made some adjustments.

Outlook

Managed Futures remains an excellent place to be given the market volatility and risk. Adding non-correlation and crisis alpha during this time is a responsible thing to do. The strategy remains non-correlated despite short term periods of challenge.