Auspice Commodity Evolution (ACE)

An ESG-aligned, rules-based strategy that tactically targets energy transition and commodity evolution markets to deliver liquid, capital-efficient inflation protection and commodity outperformance for institutional investors.

Investment Objective

The Auspice Commodity Evolution (ACE) strategy aims to capture upward trends in commodity evolution markets to produce superior absolute and risk-adjusted returns relative to passive commodity index investing. The portfolio is ESG-aligned by focusing on the commodities essential for the transition to a low-carbon economy, capitalizing on the expected demand increase and supply/demand imbalances within these “evolution” markets.

Investment Strategy

Auspice Commodity Evolution combines systematic long/flat positioning, dynamic risk management, and contract roll optimization to selectively participate in trends in commodity evolution markets while minimizing volatility and drawdowns. The strategy is futures-based, allowing investors to participate in these markets without the carbon footprint and direct environmental impact associated with the physical commodity itself.

Auspice Commodity Evolution is available via institutional managed accounts ($50mm minimum).

See the May 28th, 2025 Press Release Here.

| PERFORMANCE TABLE (Net of Fees) | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| YEAR | JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | RETURN |

| 2026 | 6.75% | 6.75% | |||||||||||

| 2025 | -0.38%** | 2.02% | -2.62% | 0.01% | 3.77% | 1.73% | 1.87% | 2.89 | 9.52% | ||||

| * Performance as at December 31st, 2025 | |||||||||||||

**ACE launched May 27, 2025. Performance for periods less than one year is not annualized. Performance data shown is for institutional use only, Auspice does not currently have a retail offering. Past results are not necessarily indicative of future results. Performance is presented net of all fees and commissions, based on an institutional managed account. Results may vary across individual accounts.

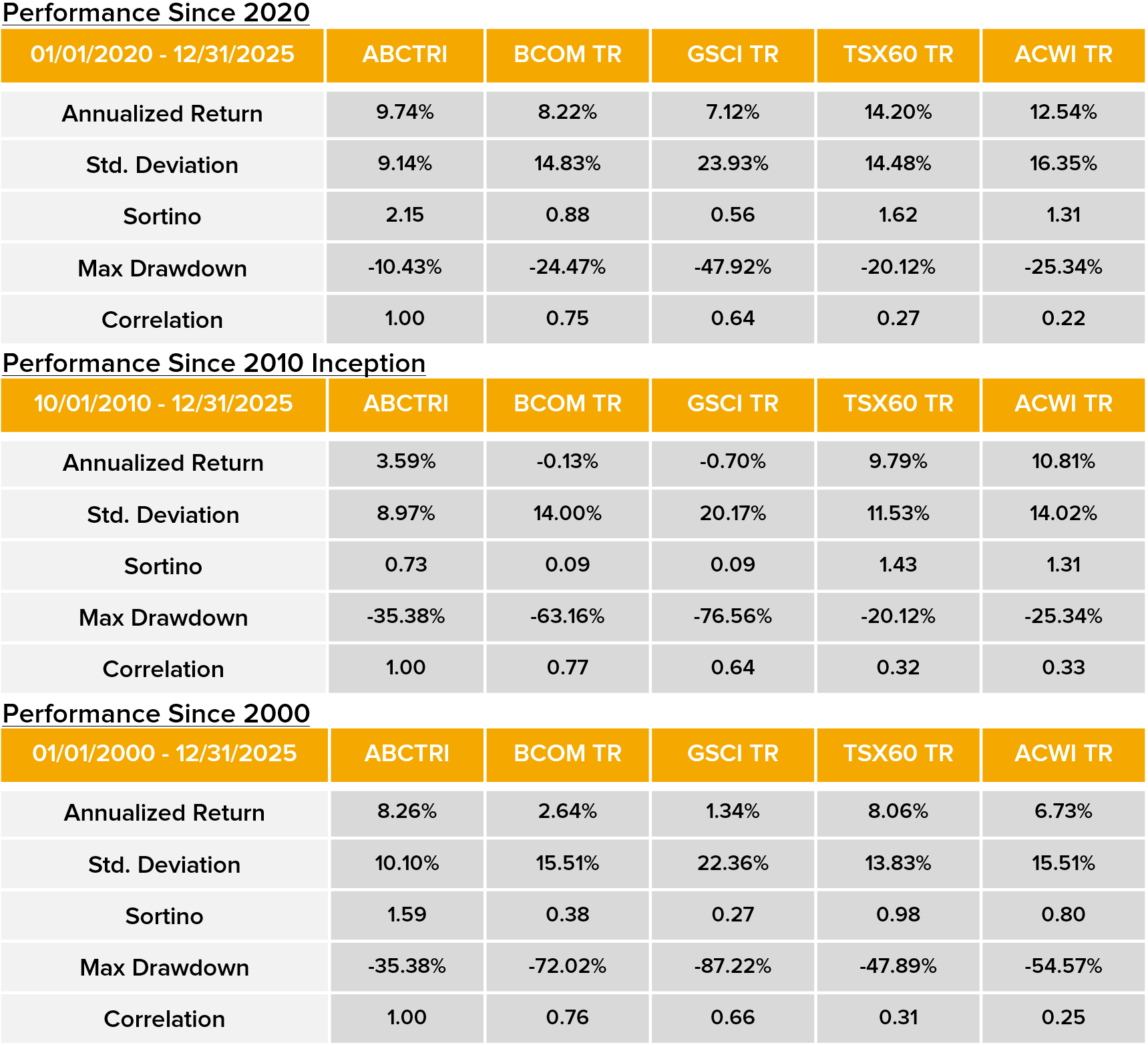

Auspice Commodity Evolution is based on the established framework of Auspice Broad Commodity, the largest Auspice strategy by AUM (>$500mm) and the #1 Broad Commodity Index since 2010.

Auspice Broad Commodity Total Return (ABCTRI)

*The performance of Auspice Broad Commodity Index prior to 9/30/2010 represents index data simulated prior to third party publishing as calculated by the NYSE from 1/1/2000. Source: Bloomberg and Auspice Investment Operations, as at December 31st, 2025. You cannot invest directly in an index.

Research and Supporting Material

“THERE’S AN EVOLUTION HAPPENING,” WHY AUSPICE LAUNCHED AN ESG-ALIGNED COMMODITY STRATEGY

(July 2025) - Benefits and Pensions Monitor Article

Despite longstanding perceptions, Auspice Capital Advisor’s Tim Pickering believes ESG investing and commodity strategies aren't mutually exclusive. In this BPM piece, Tim Pickering and Brennan Basnicki outline how the firm is bridging ESG principles with tactical commodity exposure through a redefined strategy that offers inflation protection and diversification, without the carbon footprint.

(May 2025) - Auspice Blog

For over two decades the Auspice team has pioneered innovative commodity solutions. Today we’re proud to share the launch of Auspice Commodity Evolution (ACE) – an ESG-aligned tactical commodity strategy that opportunistically trades commodity evolution and energy transition markets. This blog highlights the ACE strategy and the tactical edge it brings to ESG commodity investing.

INFLATION PROTECTION THROUGH ENERGY TRANSITION COMMODITIES

(June 2025) - Auspice White Paper

The Auspice Commodity Evolution (ACE) strategy provides ESG-aligned inflation protection by targeting materials essential to the low-carbon economy. Its rules-based, transparent approach offers daily liquidity and capital efficiency. This white paper examines how energy transition-focused commodity futures can support sustainable, inflation-aware portfolios.

COMMODITY INVESTING IN THE AGE OF ESG AND INFLATION

(November 2021) - Auspice White Paper

Whether for broad diversification or in response to increasing inflation risks, commodity futures may be the the most practical and effective solution for responsible investors looking for commodity exposure. This white paper considers commodity futures within ESG frameworks.

*The performance of Auspice Broad Commodity Index prior to 9/30/2010 represents index data simulated prior to third party publishing as calculated by the NYSE from 1/1/2000. Source: Bloomberg and Auspice Investment Operations. You can not invest directly in an index. Performance as of May 31st, 2025.

DEFINITIONS

Indices

Indices and benchmarks are used for comparison purposes only or to illustrate comparisons against other widely used indices or benchmarks most commonly referenced by investors. Index statistics/data are sourced from Bloomberg. You cannot invest directly in an index.

· Auspice Broad Commodity is a tactical long strategy that focuses on Momentum and Term Structure to track either long or flat positions in a diversified portfolio of commodity futures which cover the energy, metal, and agricultural sectors. The index incorporates dynamic risk management and contract rolling methods. The index is available in total return (collateralized) and excess return (non-collateralized) versions. Both the NYSE-listed COM (ticker) ETF and the TSX-listed CCOM (ticker) ETFs track the Auspice Broad Commodity Index.

· The Bloomberg Commodity Index Total Return (BCOM TR) Index is a broadly diversified commodity price index that tracks prices of futures contracts on physical commodities on the commodity markets. No one commodity can compose more than 15% of the BCOM ER index, no one commodity and its derived commodities can compose more than 25% of the index, and no sector can represent more than 33% of the index.

· S&P GSCI Total Return Index (GSCI TR) – A production-weighted commodity index covering a broad range of raw materials, including energy (crude oil, natural gas, gasoline, heating oil), metals (gold, silver, aluminum, copper, lead, nickel, zinc), agriculture (wheat, corn, soybeans, cotton, coffee, sugar, cocoa), and livestock (live cattle, feeder cattle, lean hogs). Its weighting heavily favors energy, making it sensitive to crude oil price movements.

· S&P/TSX Composite Index (TSX60) – The benchmark Canadian equity index, representing the largest companies listed on the Toronto Stock Exchange by market capitalization. The TSX Composite provides broad exposure to Canada’s equity markets across sectors including financials, energy, industrials, and materials. The index is float-adjusted and market-cap weighted, and it serves as the primary measure of performance for Canadian equity portfolios.

· MSCI All Country World Index (MSCI ACWI) – A global equity benchmark that tracks the performance of large- and mid-cap companies across 23 developed markets and 24 emerging markets. Covering approximately 85% of the global investable equity universe, the MSCI ACWI is market-cap weighted and includes over 2,800 constituents. The index is commonly used to represent global equity exposure in diversified portfolios.

IMPORTANT DISCLAIMERS AND NOTES

There is a substantial risk of loss in trading futures and options. Past performance is not necessarily indicative of future results.

Commissions, trailing commissions, management fees and expenses may all be associated with investment funds. Please read the prospectus or applicable offering document before investing. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

These materials are provided for informational and educational purposes and are not intended to provide specific individual advice including, without limitation, investment, financial, legal, accounting and tax. Please consult with your own professional advisor on your particular circumstances.

Futures trading is speculative and is not suitable for all customers. Past results are not necessarily indicative of future results. This document is for information purposes only and should not be construed as an offer, recommendation or solicitation to conclude a transaction and should not be treated as giving investment advice. Auspice Capital Advisors Ltd. (the “Manager” or “Auspice”) makes no representation or warranty relating to any information herein, which is derived from independent sources. No securities regulatory authority has expressed an opinion about the securities offered herein and it is an offence to claim otherwise. Please read the applicable offering documents before investing.

This material may contain forward-looking statements, which were prepared for the purpose of providing general educational background information and may not be appropriate for other purposes. Certain statements in this document are forward- looking statements, including those identified by the expressions “anticipate”, “believe”, “plan”, “estimate”, “expect”, “intend”, “target”, “seek”, “will” and similar expressions to the extent they relate to an Auspice managed investment fund (the “Fund”), where applicable, and the Manager. Forward- looking statements are not purely historical facts but reflect the current expectations of the Fund, where applicable, and the Manager regarding future results or events. Such forward-looking statements reflect the Fund’s, where applicable, and the Manager’s current, reasonable beliefs and are based on information currently available to them. Forward-looking statements are made with assumptions and involve significant risks and uncertainties. Although the forward-looking statements contained in this document are based upon assumptions that the Fund, where applicable, and the Manager believe to be reasonable, neither the Fund, where applicable, or the Manager can assure investors that actual results will be consistent with these forward-looking statements. There is no guarantee that any forward-looking statement will come to pass. As a result, readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results or events to differ materially from current expectations.

Neither the Fund, where applicable, nor the Manager assumes any obligation to update or revise any forward-looking statement to reflect new events or circumstances, except as required by law.

The information provided may contain hypertext links to web sites owned and controlled by parties other than Auspice. We have no control over any third-party-owned web sites or content referred to, accessed by or available on such web site and therefore we do not endorse, sponsor, recommend or otherwise accept any responsibility for such third-party web sites or content or for the availability of such web sites. In particular, we do not accept any liability arising out of any allegation that any third-party-owned content (whether published on this or any other web site) infringes the intellectual property rights of any person, or any liability arising out of any information or opinion contained on such third-party web site or content.

The forward-looking statements contained herein were prepared for the purpose of providing prospective investors with general educational background information about the Funds and may not be appropriate for other purposes. None of the Fund or the Manager assumes any obligation to update or revise them to reflect new events or circumstances, except as required by law.

Auspice is an innovative alternative asset manager that focuses on applying rules-based investment strategies across a broad range of commodity and financial markets. Auspice offers liquid alternative and commodity strategies that provide the benefits of active management and the efficiency of indexing. Auspice works with a wide range of clients and develops solutions to improve their portfolio or product suite. Auspice strategies are available directly to institutions, financial professionals and high-net-worth individual investors as well as retail investors through the Auspice brand along with sub-advisory and licensing arrangements. www.auspicecapital.com