Download the commentary here.

The Auspice Diversified Program was down 0.70% in August.

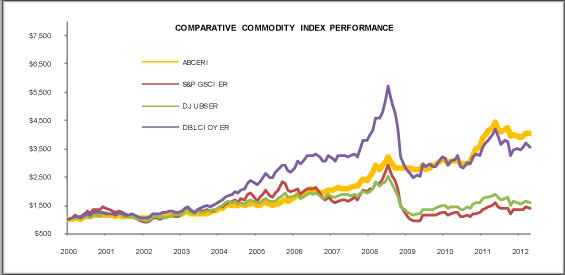

August was highlighted by uptrends in the commodity markets. While we were positioned to take advantage of some of these uptrends in Energy and Grains, further uptrend saw changes to the portfolio in the Metal, Softs and Equity Indices sectors. As such, while the portfolio was positioned defensively at the end of Q2 (tilted short), we have continued a shift to the long side which was started in July. The uptrends triggered position changes in commodities (Metals, Softs, Energies and Equity Indices) where we have reduced shorts or added new long positions.

The Auspice Diversified Program was profitable in 4 of the 7 sectors traded with largest gains from Energies, Grains and Metals and a small gain from Equities during the month. Concentrated losses in Softs, Interest Rates and Currencies slightly offset these gains for a small loss.

Interesting Trades: Two of the strongest markets during the month were Gasoline and Soybeans. Additionally, while not a massively profitable trade, a short exit in Palladium highlights our ability to be agile in the face of a trend reversal. In this case, we exited the short prior to an extended and sharp upside move. Lastly, we have re-entered Natural Gas short and added a new long in Gold.

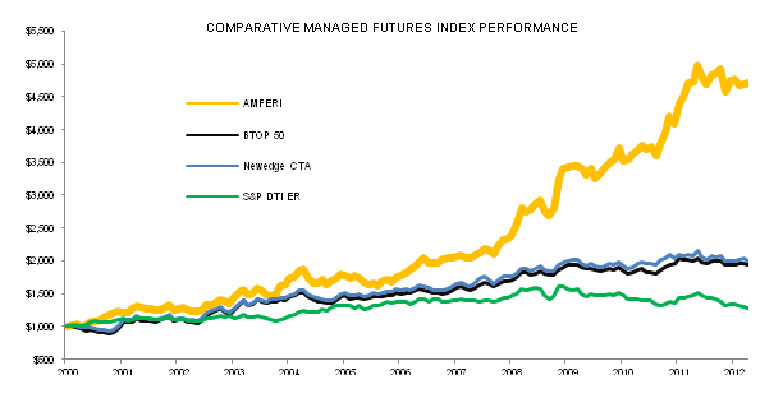

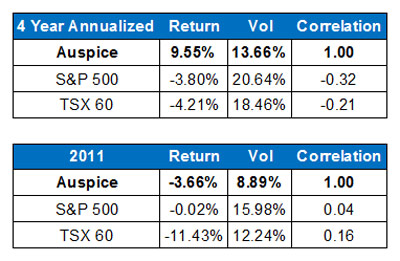

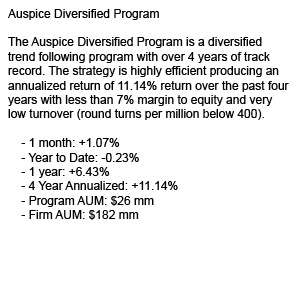

The 5 year statistics (Sep 07 - Aug 12) are: +8.99% annualized return with 13.11% volatility. The worst drawdown for the period is 13.93% with an average Margin to Equity ratio of 6.4%. The global equity markets remain down (-1 to -5% annualized) over this same period with 20-35% more volatility and deep drawdowns of 40-55%. Over the long run, the performance of the Auspice Diversified Program highlights not only the non-correlation and absolute return characteristics of the strategy, but the lower risk profile from traditional investments due to stringent risk management and downside protection.

ADDITIONAL REFERENCES

- Advisor.ca article dispels some of the myths regarding managed futures.

- Listen to a podcast interview with Tim Pickering, President of Auspice and Michael Covel, a leading author specializing in Managed Futures and trend following.

- For those interested in more ideas about investing in alternatives, please check out the www.amfmblog.com.

Key Points Regarding our Positions

Energies: After covering shorts in many Energy markets in July, the market continued to show strength. While we remain on the sidelines in Crude and Heating Oil, Gasoline soared making most of the sector gains from the long side. After exiting Natural Gas in July, we have re-entered from the short side on late month weakness.

For those with specific interest in this sector alone, please contact Auspice regarding the launch of our Energy focused strategy in collaboration with Pulse Capital Partners. The program went live on March 2nd.

Metals: The Metals sector was marginally profitable with some notable position changes. First, we added a new long position in Gold as this market is picking up momentum. We also exited the short in Palladium prior to the aggressive rally that occurred mid month. Lastly, while Copper was profitable from the short side in July, the price rallied against the trend in August. We remain short Copper despite the recent rally. This sector is no longer tilted short and will be one to watch for further upside.

Grains: Grains also provided reward in August where we are holding the same positions where we remain on the sidelines in Wheat, but are long Corn and Soybeans.

Soft Commodities: With the exception of Coffee, the Softs markets followed the rest of commodity rally higher. While we remain short Cotton, we added a short in the Coffee market on its individual weakness. We are on the sidelines in Lumber and OJ at month end. This sector was not profitable in August.

Currencies: Currencies were very challenging in August as many markets reversed sharply. We exited our long positions in Japanese Yen and the US Dollar index as well as a short in the Swiss Franc. We have added a Canadian dollar position to the long Aussie dollar position. We remain short the Euro and remain on the sidelines in the British Pound.

Interest Rates: Rates were challenging in August as they sold off aggressively in the first half of the month only to reverse and head higher in the latter part. We covered some of our long positions defensively in the short end of the curve (US 2 and 5 year Notes) mid month. We remained long 30 year Bonds and US 10 year Notes (since early 2011) and re-entered 5 years at month end.

Equity Indices: After starting to tilt the Equity portion of the portfolio long in July, we have furthered that position slightly in August resulting in a small gain in the sector. We added the Nasdaq index late in the month while covering our short in the Nikkei. This adds to the existing long positions in Russell 2000 and S&P. We remain on the sidelines in Hong Kong’s Hang Seng and the French CAC 40.

*Returns repesent the performance of the Auspice Managed Futures LP Series 1.