The Auspice Diversified Program was down 3.44% in December.

For those that missed our announcement in late November, Auspice was awarded a Silver medal by Morningstar in the category of Best Opportunistic Hedge Fund.

Monthly Commentary:

We entered December with continued momentum in trends from November, but the month ended up very choppy. While December is often quiet, the continued efforts by government and central bank forces continued to destabilize market trends. We are optimistic that this will soon pass and that government’s will soon focus on their raison d’être and leave the market to find a path.

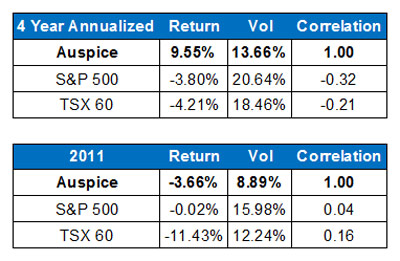

The equity markets were very choppy during the month of December. Some indices fought back to flat on the year (S&P 500) but most remained in the red or in significant negative territory (S&P TSX 60 for example). Regardless, the volatility and risk associated with the equity market remains very high. As illustrated in the table, while the Auspice strategy had a small loss on the year, the correlation to equity remains very low (to non-existent) in times of similar performance while the volatility is markedly lower.

Additionally, for those interested in more info and ideas about investing in alternatives, please check out AMFM Blog.

Since full diversification (achieved in June 2007) the annualized return is +8.90% with 13.47% volatility, 25-30% lower volatility than the Equity market. The global equity markets remain down over this same period.

Interesting trades: We exited our long term Gold trade near month end. This position has been long since February 2009, over 1050 days. This change is interesting as it could be a catalyst for other trends and capital flows that create trends. We also saw a shift to short currencies vis-a-vis the USD.

Key Points Regarding our Positions

Energies: Despite overall choppiness, the energy sector was profitable on the month. We took a short position in Crude at mid month as weakness showed up again. However, the trade was short lived as the market bounced back aggressively. We exited a long Heating Oil position that was entered in October further illustrating the choppiness within Energy. We remain short Natural Gas which was very profitable on the month. We firmly believe that there is a great opportunity developing in Energy and it has been taken advantage of in the last quarter. For those with specific interest in this sector alone, please contact Auspice regarding the launch of our Energy focused strategy.

Metals: Gold continued the sell-off that started in November and was exited during the month. This marks one of the longest trades we have ever held and returned approximately 6 times initial capital risked. We also exited a short position in Palladium with a modest gain. We remained out of Copper and hold no other Metals positions at this time. This sector was very choppy in December and throughout Q3.

Grains: Our positions remain the same in Grains but were not profitable on the month. We are short Soybeans and Wheat which both bounced back after being very profitable in the direction of trend in November. We remain flat Corn.

Soft Commodities: Orange Juice again continued to trend higher and we remain long. Coffee broke out of its sideways pattern and we took a new short position. Cotton remains sideways which we are not participating at this time. Lumber remains choppy and we have covered our short.

Currencies: Currencies were profitable during December and we only made one change. We added a long position in US Dollar index mid month. As noted last month, we made a number of changes in October and November where there was a shift to short currencies in general. The long US Dollar index during December highlights this shift. At month end, we are short Swiss Franc, British Pound, Canadian Dollar, and the Euro. We are flat Yen and Aussie Dollar.

Interest Rates: Rates were profitable as we added to the short end of the curve with 5 year notes. We remain long US 10 Year notes and 30 year bonds.

Equity Indices: We covered some shorts as the equity market chopped around with little direction. During the month we covered in Hang Seng and Russell 2000 while remaining short in Nikkei. At month end we are also flat Nasdaq and S&P 500. This sector is giving some mixed signals, so will be one to watch for direction early in 2012.