The pain consumers have felt from inflation is significant. Amid rising food inflation, Kellogg’s CEO suggests poor families should “eat corn flakes for dinner”.[1] These comments, broadly insensitive, speak to the severity of the real inflation consumers are facing, much of which is masked by headline inflation metrics.

Further “Greedflation” – when a company hikes prices beyond the rate of inflation inorder to increase profits – is further forcing families to make choices like eating cereal for dinner to save money”[2]. Consider that:

In 2022, consumers spent 11.3% of their disposable income on food, the highest level since 1991[3].

Consumers have been forced to spend about 26% more on groceries in general since 2020[4].

In Canada food prices are expected to increase a further 2.5% to 4.5% on top of already high prices in 2024[5] (we think it could be even higher).

This pain consumers are facing will not abate in the near future in our opinion. In fact, we expect it will become worse. Amidst sustained high prices that are still increasing, there are increasing warnings for those expecting any further softening in inflation, particularly for food prices and so called “agflation”.

Agflation

We have commented twice on the emerging agflation risk – see the original Auspice May Agflation Blog alongside a second Auspice Agflation Blog post July 2023. We broadly think agflation is going to be a risk as it is driven by two factors that central banks rate hikes broadly don’t affect – wages, and commodity prices.

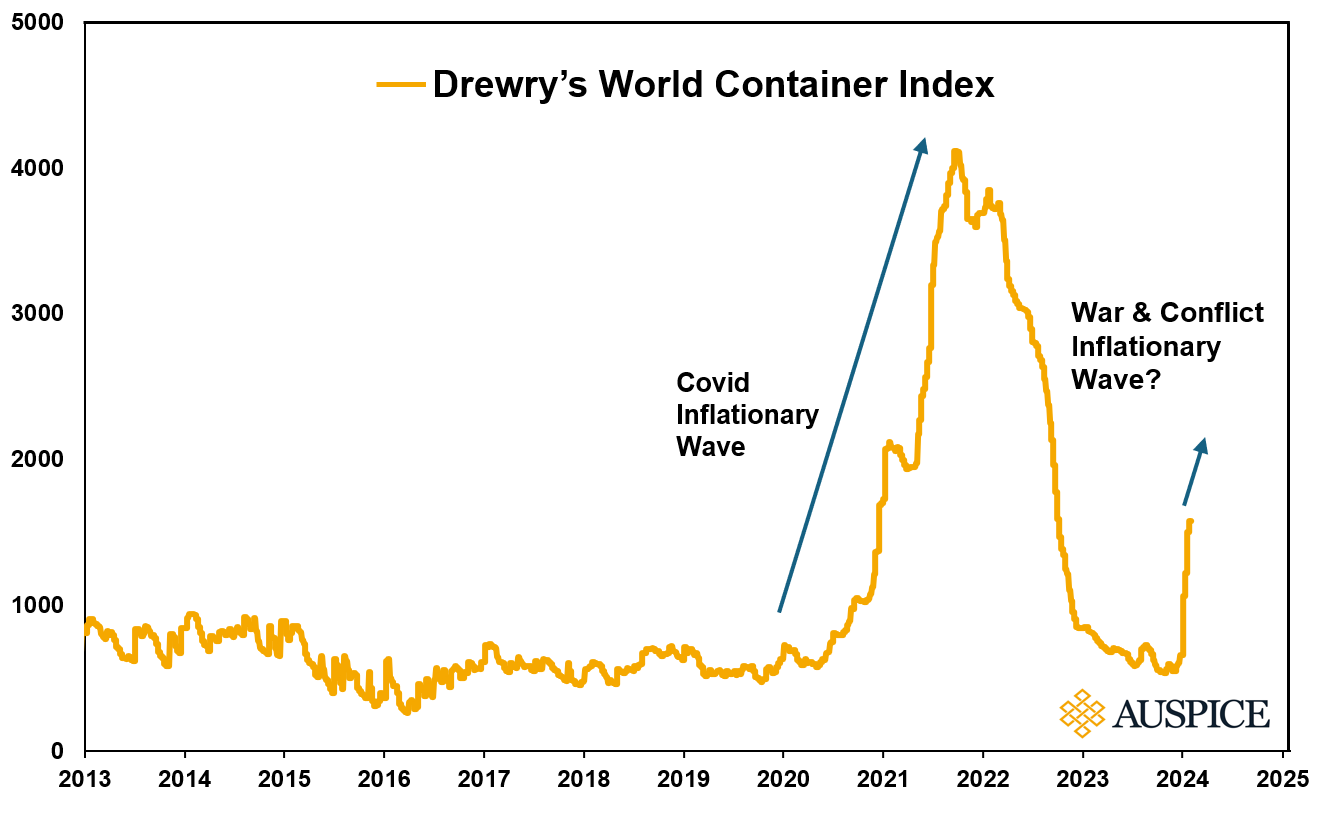

While we are all aware of the current wage pressures from labour shortages, unionization, and aging demographics, for the purpose of this Blog, we’ll focus on the latter, commodities. First, and this relates to inflationary pressures beyond the food supply, there has been a surge in freight rates and the World Container Index (see Chart 1 below). As discussed in the January 2024 Auspice Blog, the number of wars and global conflicts are at the highest levels since WWII[6]. This is likely a key driver in the increase of freight rates, and with the spike just commencing recently in 2024, we likely are on the precipice of higher prices for both raw and manufactured goods.

Chart 1 – 10yr World Container Index Prices, February 1st, 2014, to January 31st, 2024.

Source: Auspice Capital Advisors and Bloomberg, as at February 29th, 2024.

Further, consider Chart 2 below. There are two important things to note:

Agricultural commodity prices – cocoa, cattle, coffee, sugar, corn, and more – things we rely on daily that disproportionately affect lower income families, are on the rise. While the broad base Goldman Sachs (GSCI) and Bloomberg (BCOM) benchmarks continue to consolidate, agricultural prices are making multi-year highs. This does not bode well for future inflation.

In Canada food inflation has persisted, for many factors including shipping, however in the rest of the world, there has been a softening in food prices as seen in the UN Food and Agriculture World Food Price Index. Historically, this food Index tracks agricultural commodity prices – an understandable relationship. Recently there has been a divergence, and particularly as freight rates begin to skyrocket upwards, it is logical to expect global food prices to resume back upwards as agricultural commodity inputs do.

Chart 2 – Agricultural Commodities & Food Prices, February 1st, 2014, to January 31st, 2024.

Source: Auspice Capital Advisors and Bloomberg, as at February 29th, 2024.

We have warned that higher rates can only affect the demand-pull side of the inflation equation (i.e. demand for manufactured goods and consumer spending). Raising rates does little to affect the cost-push side of the inflation equation - inflation driven by wages and commodities. We are seeing this in real time – rates remain elevated, yet many commodity markets have resumed their upwards course. Tight commodity supply coupled with record high levels of global war and conflict does not bode well for future disinflation.

Global elections are taking the news spotlight but the resumption of the commodity supercycle may be of higher importance for investors. Higher commodity prices have implications across asset classes and comes at a time when rates cut expectations have already become muted. The inflation narrative by central banks may start to change and accept this new structural reality.

We are now two years since the Russia/Ukraine volatility peak in broad commodity indices, a normal consolidation period within a broader cycle (see Chart 2 in the Auspice January Blog), and the next move upwards may have begun.

If you don’t have a 5-10% commodity or CTA allocation, connect with us today at info@auspicecapital.com.

DEFINITIONS

The DBIQ Diversified Agriculture Index Excess Return is a rules-based index composed of futures contracts on some of the most liquid and widely traded agricultural commodities.

The UN Food and Agriculture World Food Price Index (FAO Food Price Index) is a food price index by the Food and Agriculture Organization (FAO) of the United Nations. It records the development of world market prices of 55 agricultural commodities and foodstuffs.

The Drewry World Container Index (WCI) measures the bi-weekly ocean freight rate movements of 40-foot containers in seven major maritime lanes. It is expressed as an average price per 40-foot container (in US$).

IMPORTANT DISCLAIMERS AND NOTES

Some of the assumptions and opinions contained herein are the view or opinion of the firm and are based on management's analysis of the portfolio performance.

Prior to February 28, 2023, Auspice Diversified Trust was offered via offering memorandum only and this Fund was not a reporting issuer during such prior period. The expenses of the Fund would have been higher during such prior period had the Fund been subject to the additional regulatory requirements applicable to a reporting issuer. Auspice obtained exemptive relief on behalf of the Fund to permit the disclosure of the prior performance data for the Fund for the time period prior to it becoming a reporting issuer.

Commissions, trailing commissions, management fees and expenses may all be associated with investment funds. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

The contents on this website are provided for informational and educational purposes and are not intended to provide specific individual advice including, without limitation, investment, financial, legal, accounting and tax. Please consult with your own professional advisor on your particular circumstances.

Futures trading is speculative and is not suitable for all customers. Past results are not necessarily indicative of future results. This document is for information purposes only and should not be construed as an offer, recommendation or solicitation to conclude a transaction and should not be treated as giving investment advice. Auspice Capital Advisors Ltd. makes no representation or warranty relating to any information herein, which is derived from independent sources. No securities regulatory authority has expressed an opinion about the securities offered herein and it is an offence to claim otherwise. Please read the offering documents before investing.

Certain statements in this document are forward- looking statements, including those identified by the expressions “anticipate”, “believe”, “plan”, “estimate”, “expect”, “intend”, “target”, “seek”, “will” and similar expressions to the extent they relate to the Fund and the Manager. Forward- looking statements are not historical facts but reflect the current expectations of the Fund and the Manager regarding future results or events. Such forward-looking statements reflect the Fund’s and the Manager’s current beliefs and are based on information currently available to them. Forward-looking statements are made with assumptions and involve significant risks and uncertainties. Although the forward-looking statements contained in this document are based upon assumptions that the Fund and the Manager believe to be reasonable, neither the Fund or the Manager can assure investors that actual results will be consistent with these forward-looking statements. As a result, readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results or events to differ materially from current expectations.

The forward-looking statements contained herein were prepared for the purpose of providing prospective investors with general educational background information about the Funds and may not be appropriate for other purposes. Neither the Fund or the Manager assumes any obligation to update or revise them to reflect new events or circumstances, except as required by law.

This blog may contain hypertext links to web sites owned and controlled by other parties than Auspice. We have no control over any third-party-owned web sites or content referred to, accessed by or available on this web site and therefore we do not endorse, sponsor, recommend or otherwise accept any responsibility for such third-party web sites or content or for the availability of such web sites. In particular, we do not accept any liability arising out of any allegation that any third-party-owned content (whether published on this or any other web site) infringes the intellectual property rights of any person, or any liability arising out of any information or opinion contained on such third-party web site or content

REFERENCES

[1] https://www.theguardian.com/us-news/2024/feb/27/kelloggs-ceo-cereal-for-dinner

[2] https://www.dailymail.co.uk/news/article-13128747/Kelloggs-CEO-slammed-telling-Americans-eat-corn-flakes-dinner.html

[3] https://www.cnn.com/2024/02/26/food/kellogg-ceo-cereal-dinner/index.html

[4] https://www.theguardian.com/us-news/2024/feb/27/kelloggs-ceo-cereal-for-dinner

[5] https://www.dal.ca/news/2023/12/07/canada-food-price-report-2024.html

[6] https://www.auspicecapital.com/alt-invest/2024/2/2/not-a-world-war-but-a-world-at-war