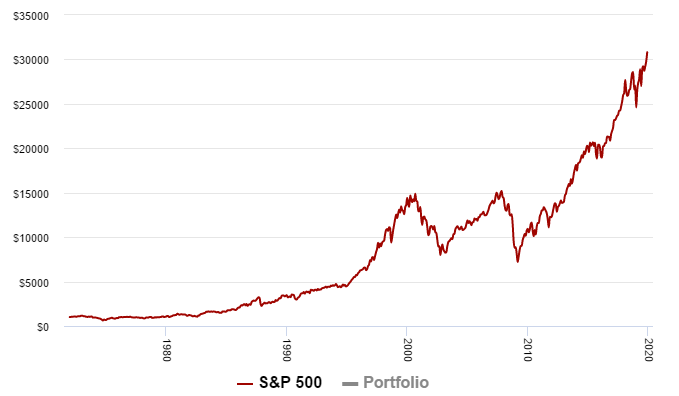

How does one navigate a market that seemingly goes up at a 45 degree angle, with low volatility, for a decade? It’s not like it hasn't happened before - from 1990 to 2000 prior to the dot-com correction, the S&P500 grew at 13% annualized with a 16% pullback - very similar to the current run from 2009 at 12% annualized with a 17% pullback (peak to trough monthly). Eerily similar. While we know that corrections are inevitable, we tend to ignore this risk during great runs. Will it be 10%? 15%? 20%? The correction in 2018 was 20% to the day. Was that enough? Look at the chart - what do you think?

History shows us that we can expect 40-50% plus from time to time. While some may argue that those times (2001 tech or 2008 financial crisis) were driven by specific events, we can't disagree. But here is the thing – the cause wasn’t obvious until the dust settled. And we don't see the next "event" any different. What will it be this time? Or what are the risks and catalysts?

Recent bank (repo) liquidity crisis?

US election uncertainty that could change tax and financial policies?

Slowing global economy and trade concerns?

Manufacturing PMI at recessionary levels?

Delinquencies rising in some retail areas such as auto loans?

Valuations of stocks now believed to be higher than prior to Tech bubble and the end of the roaring twenties?

Massive Corporate debt?

How does one protect themselves from the downside risk? One way is to do what Ray Dalio has done recently at the world’s largest hedge fund. Bridgewater has made a $1.5 billion dollar bet stocks fall by March 2020 by buying put options that will pay off if the market drops precipitously. This is one option.

Another way to protect the downside risk is with diversification that lasts longer than the near term. One of the best diversifiers to an equity tilted portfolio is Managed Futures. The correlation is low and generally negative when equities are selling off causing performance at a critical time. In 2008, our flagship portfolio added over 44%.

This is what we do at Auspice. Give us a call.

Disclaimer below

IMPORTANT DISCLAIMERS AND NOTES

Futures trading is speculative and is not suitable for all customers. Past results are not necessarily indicative of future results. This document is for information purposes only and should not be construed as an offer, recommendation or solicitation to conclude a transaction and should not be treated as giving investment advice. Auspice Capital Advisors Ltd. makes no representation or warranty relating to any information herein, which is derived from independent sources. No securities regulatory authority has expressed an opinion about the securities offered herein and it is an offence to claim otherwise.

QUALIFIED INVESTORS

For U.S. investors, any reference to the Auspice Diversified Strategy or Program, “ADP”, is only available to Qualified Eligible Persons “QEP’s” as defined by CFTC Regulation 4.7.

For Canadian investors, any reference to the Auspice Diversified Strategy or Program, “ADP”, is only available to “Accredited Investors” as defined by CSA NI 45-106.