One of the first things you learn about the markets as a trader, is they can stay irrational longer than you can stay solvent. As a trader at a conservative Canadian bank, minding the bank roll was key- risk one to make three. As stocks dominating today's headlines can deviate from rational valuation (Gamestop, Tesla, AMC etc) due to systemic flaws, commodities can do the same. Was crude oil fairly valued at $147 per barrel in 2008? Was it worth less than $0 in April 2020? Not likely. But the market will do what it wants and investor psychology, fear, greed and panic can definitely move markets beyond fundamentals - yet only to a point.

While commodities can also deviate, the motivations of the diversified players in the commodity markets generally pull values back to reality. While speculators are important to the function of all markets, commodity and financial, hedging by commodity producers, consumers and the power of financial to physical arbitrage and storage are structural differences. It is not the same for Tesla.

As such, fundamentals matter and while this may seem funny to say from a quantitative investment group, it underlies a key principle, the question is when. Sentiment and behavioral science also matter. To that end, commodities have been "unpopular" for some time. Some pundits have gone as far as claiming that commodities simply don't matter anymore - the world is technologically driven. Moreover, given commodities often come with some sort of environmental or social footprint, it is not an attractive area to invest or look for opportunity. We believe nothing could be further from the truth and the hypocrisy of the day.

While the diversification opportunities are obvious (Cotton is not Crude is not Corn), from an ESG perspective, consultants have weighed in: Mercer – “Commodities will remain an essential component of the economy, and investors should note that there is no transition pathway to a climate-neutral world that does not involve commodities (1).” Clearly, calling out commodities “full stop” is premature.

From a supply and demand perspective, the demand for commodities is strong. The world is growing, emerging markets are developing, and we produce more goods than ever before. Commodities generally are the inputs to those goods. Commodities are the inputs to infrastructure and last time I checked; we haven't stopped eating. While personal and business travel may be curtailed, transportation and shipping of goods has not been, it has increased (2).

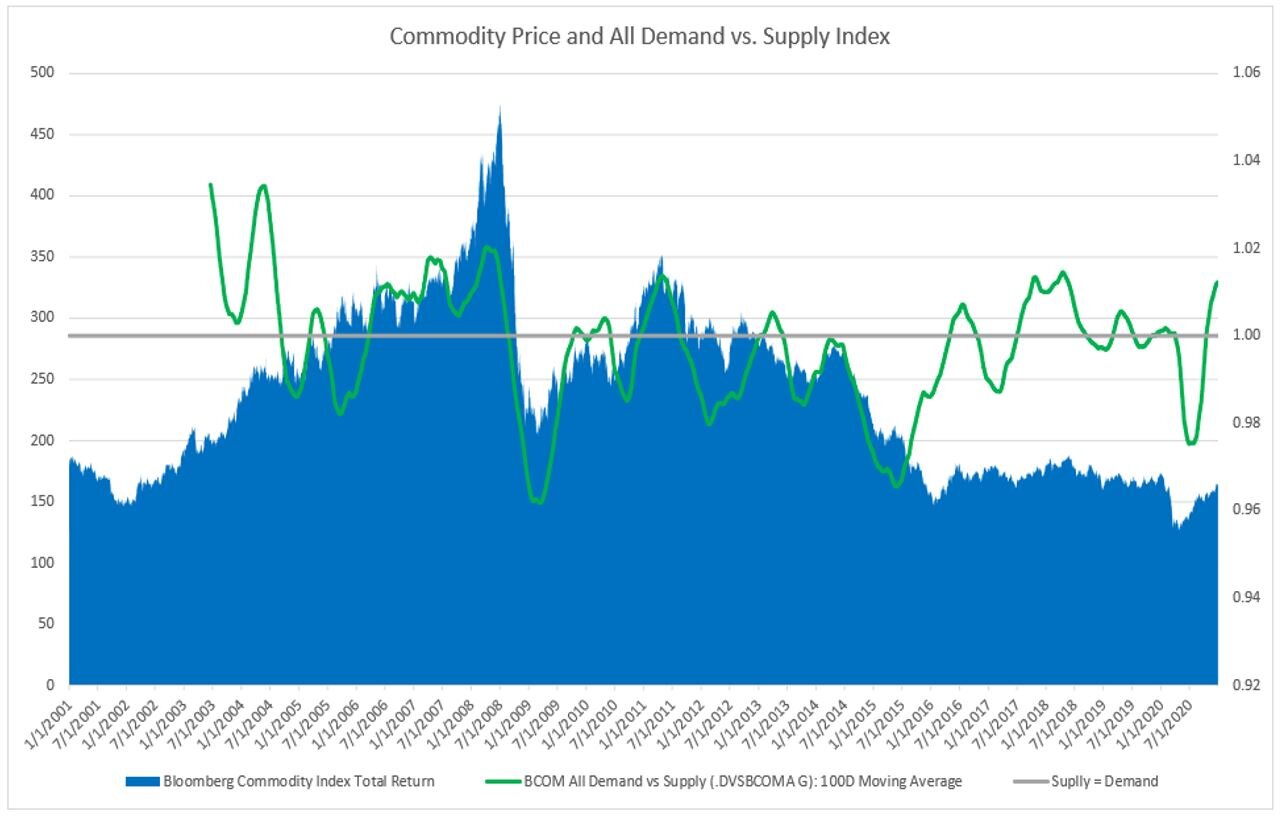

As the chart illustrates, the Demand versus Supply ratio is back over 1, indicating more demand than supply, a trend that started in 2015 and only temporarily dipped in 2020 as the pandemic hit. Post Q1 2020, commodities and the index benchmarks rallied sharply, and it aligns with the demand picture. Per Goldman Sachs: “Every single commodity market with the exception of wheat is in a deficit today”. “It's the beginning of a structural bull market not only in oil, but across the entire commodity complex (3).”

As a quantitative investor in commodities, it doesn't mean we have fallen in love with the story and bet the farm. What it means is that while commodities have been a bear story for the better part of a decade, giving us fewer opportunities to tactically benefit from upside trends, the landscape is changing. A shift is occurring. While limiting downside better than a long-only approach is the bedrock, our unemotional and tactical approach based on actual momentum now has a bigger opportunity set.

And by the way, we are 100% comfortable with irrational and volatile markets and the opportunities they afford us and our investors.

1. https://www.mercer.com/our-thinking/wealth/responsible-investment-in-commodities.html

2. https://www.freightos.com/freight-resources/coronavirus-updates/

3. https://www.spglobal.com/platts/en/market-insights/topics/platts-infographics

Disclaimer below

IMPORTANT DISCLAIMERS AND NOTES

Futures trading is speculative and is not suitable for all customers. Past results are not necessarily indicative of future results. This document is for information purposes only and should not be construed as an offer, recommendation or solicitation to conclude a transaction and should not be treated as giving investment advice. Auspice Capital Advisors Ltd. makes no representation or warranty relating to any information herein, which is derived from independent sources. No securities regulatory authority has expressed an opinion about the securities offered herein and it is an offence to claim otherwise.

QUALIFIED INVESTORS

For U.S. investors, any reference to the Auspice Diversified Strategy or Program, “ADP”, is only available to Qualified Eligible Persons “QEP’s” as defined by CFTC Regulation 4.7.

For Canadian investors, any reference to the Auspice Diversified Strategy or Program, “ADP”, is only available to “Accredited Investors” as defined by CSA NI 45-106.