Stagflation?

While some economists continue to cherry pick various data points to suggest that inflation will be transitory, there is an increasing amount of big picture thinker skepticism:

"If our solution is entirely just to get a green world, we’re going to have much higher inflation, because we do not have the technology to do all this, yet,” - Larry Fink (1)

"The stagflation of the 1970s will soon meet the debt crises of the post-2008 period. The question is not if but when." – Nouriel Roubini (2)

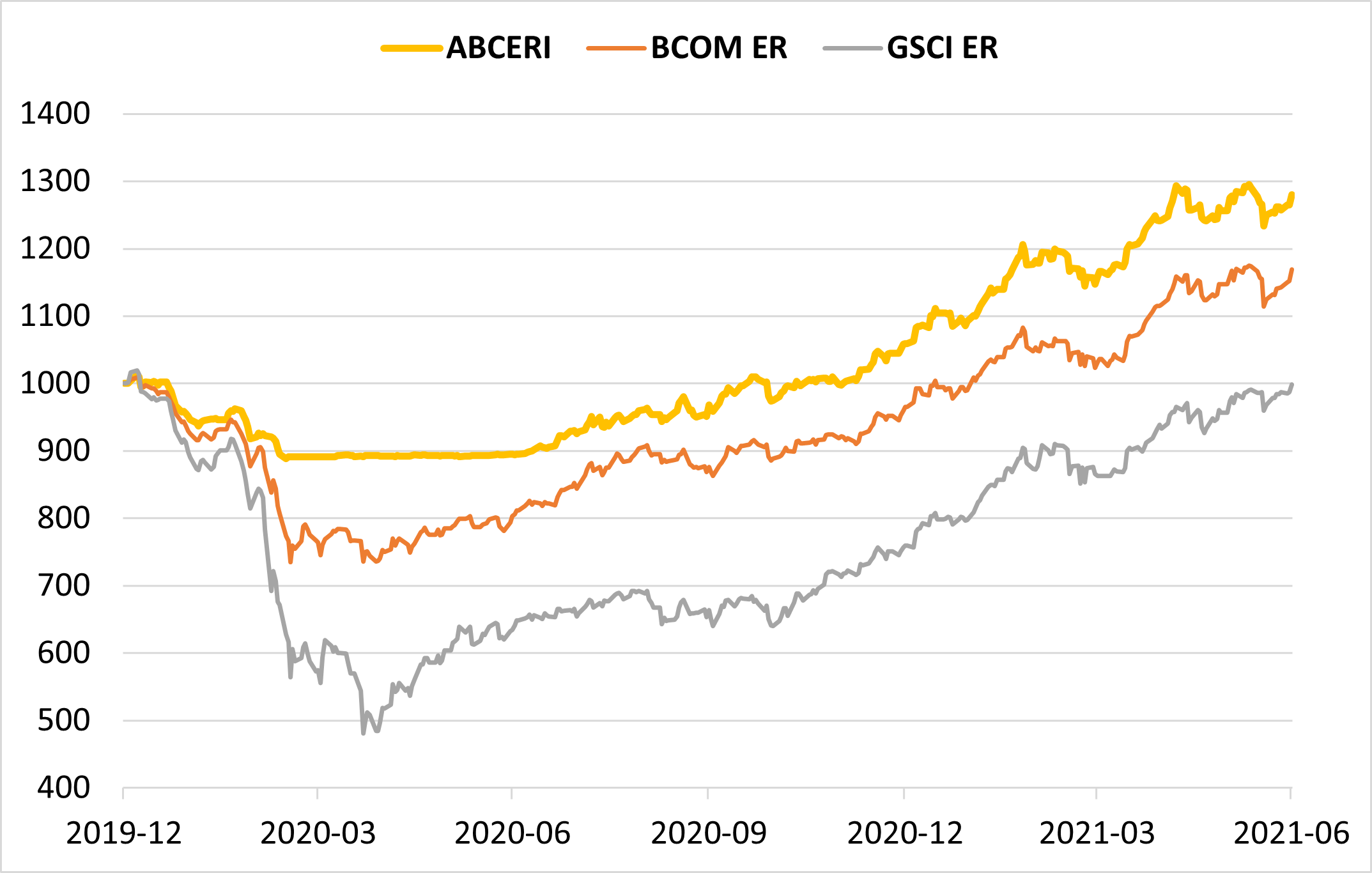

This is consistent with a review of recent commodity market performance. While skeptics will point out that lumber has corrected from highs around $1700 to $700, broad commodity indexes continue their march upwards. The energy concentrated GSCI led last month, with the more diversified BCOM and ABCERI pushing well above pre-covid levels. ABCERI has now marked 3 consecutive months of new highs, and only one negative month (March 2021) in the last 15 per (daily) chart below.

Whether it's the sustained rally in commodities (chart above), record used vehicles prices(3), or the $15 minimum wage coming to the US and Canada(4), the idea that inflation will be short-term transitory appears bleak. Every month we see new data points dispelling the idea. Moreover, while still using the transitory word, Federal Reserve officials expect to start raising US interest rates in 2023, earlier than previously forecasted(5), according to economic projections that included sharply higher inflation this year. Other jurisdictions like Mexico have already started raising rates(6).

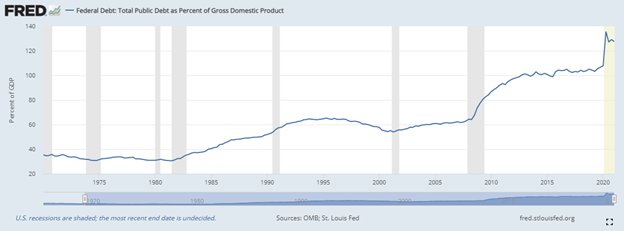

When Volcker raised rates in the early 1980s, the result was a severe double-dip recession in the United States, a debt crisis, and a lost decade for Latin America(7). Today global debt ratios are almost three times higher.

In the US total public debt to GDP is almost 3.5x levels experienced in the 1970s.

Source: https://fred.stlouisfed.org/series/GFDEGDQ188S

In Canada our debt to GDP has increased by a whopping 80% since Q4 2019 alone.

Source: https://www.visualcapitalist.com/debt-to-gdp-continues-to-rise-around-world/

The question to us is not if inflation is here – we have now entered year two - but rather how long it will last and if it will be a constructive inflationary period or a more harmful stagflationary regime?

Tough question.

A better question – is your portfolio diversified? Do you have investments that do well in an inflationary or stagflationary regime?

References

https://www.canada.ca/en/employment-social-development/news/2021/06/nr---minimum-wage.html

https://www.wsj.com/articles/bank-of-mexico-raises-interest-rates-in-split-decision-11624563224

https://www.federalreservehistory.org/essays/latin-american-debt-crisis

Disclaimer below

IMPORTANT DISCLAIMERS AND NOTES

· The Auspice Broad Commodity strategy combines opportunistic commodity exposure with capital preservation. Returns for Auspice Broad Commodity Excess Return Index or “ABCERI” represent returns calculated and published by the NYSE. ABCERI index calculated and published by NYSE since Sep. 2010. The index does not have commissions, management/incentive fees or operating expenses.

· The Bloomberg Commodity (Excess Return) Index (BCOM ER), is a broadly diversified index that allows investors to track 19 commodity futures through a single, simple measure. Excess Return (ER) Indexes do not include collateral return.

· The S&P Goldman Sachs Commodity Excess Return Index (GSCI ER), is a composite index of commodity sector returns representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities.

Futures trading is speculative and is not suitable for all customers. Past results are not necessarily indicative of future results. This document is for information purposes only and should not be construed as an offer, recommendation or solicitation to conclude a transaction and should not be treated as giving investment advice. Auspice Capital Advisors Ltd. makes no representation or warranty relating to any information herein, which is derived from independent sources. No securities regulatory authority has expressed an opinion about the securities offered herein and it is an offence to claim otherwise.

QUALIFIED INVESTORS

For U.S. investors, any reference to the Auspice Diversified Strategy or Program, “ADP”, is only available to Qualified Eligible Persons “QEP’s” as defined by CFTC Regulation 4.7.

For Canadian investors, any reference to the Auspice Diversified Strategy or Program, “ADP”, or Auspice One Fund “AOF”, is only available to “Accredited Investors” as defined by CSA NI 45-106.