Publication Date: November 1st, 2023

Following an October 2022 trip by Auspice Founder/CIO Tim Pickering to Asia alongside additional research, the Auspice team has been highlighting that we believe India is emerging as the largest driver of the emerging commodity supercycle; expected to consume significantly as China did in the early 2000s.

For background see the Auspice December and January blog posts on India. The outlook can be summarized as follows:

India became the world's largest population in 2023[1].

India has a rapidly growing middle class, expected to become the world's largest by 2027[2].

Commodity consumption is a function of population and income but disproportionately affected by income, i.e., middle class consumption.

As a country becomes more prosperous and its population transitions from lower to middle class, its people move from a subsistence life to one where they start consuming more goods and services. As incomes rise, the government also taxes and spends more, particularly on (commodity intensive) infrastructure.

The Indian government doubled CapEx in 2023 (from 2020) to nearly 20% of its budget[3].

This is what occurred in China in the early 2000s and what we are witnessing today in India. Indian consumption is expected to double from $2tn in 2022 to $4.9tn by the end of 2030 and surpass China[4].

As an indication of the timeliness, consider Figure 1 below. As the Indian population grows and demands more goods, India has begun banning exports of many agricultural markets including Wheat, Rice, and Sugar.

Figure 1 – 2023 Agricultural Market Export Bans in India.

Source: Auspice Capital Advisors and Reuters.

Given the structural shortage in commodities (see here and here for more), a disruption in supply can create significant price volatility and appreciation. While a muted affect for Wheat and Rice (rice prices still up over 50% in the last 5 years), for sugar, the India export bans drove global prices to 10-year highs in April and then again in September (as depicted in figure 1 above).

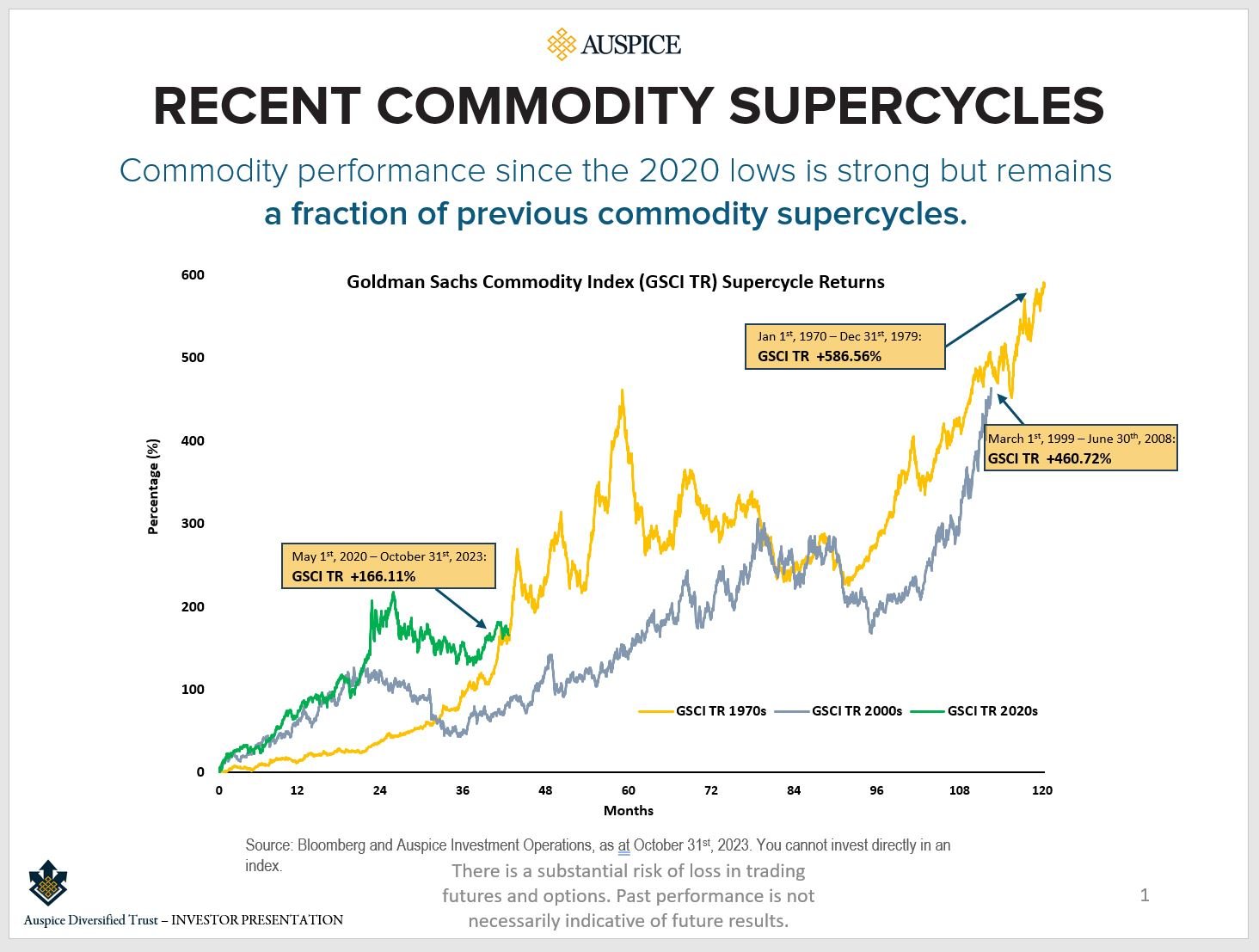

Alongside agricultural market strength, Auspice expects to see similar volatility and price appreciation in other sectors such as the more CapEx intensive energy and metals sectors. Notably, while there was significant price appreciation of the benchmark Goldman Sachs (“GSCI TR”) Commodity Index from May 2020 to the April 2022 Russia/Ukraine invasions highs, the performance of the current cycle remains a fraction of previous as the chart depicts with overlays on the 2000’s and 1970’s commodity cycles.

Figure 2 – Recent Commodity Supercycles.

Source: Auspice Capital Advisors and Bloomberg.

Auspice sees a potential big runway in 2024 based on: 1) commodity cycle, 2) equity volatility and 3) inflation stickiness. The reality is the central banks have an ability to affect consumer spending, that’s the critical lever they have: i.e., raise rates to dampen "demand-pull" inflation (demand for manufactured goods). What they don't have is a lever for "cost-push" inflation driven by commodity prices and wages. They can't control that without damaging or destroying the economy with much higher rates. Unless we go back to a QE, zero rate, no inflation and no volatility environment, we believe our outlook is good.

For information about the Auspice product suite and how we can help, email us today at info@auspicecapital.com.

DEFINITIONS

BENCHMARK DESCRIPTIONS

The S&P Goldman Sachs Commodity Excess Return Index (“S&P GSCI ER”), is a composite index of commodity sector returns representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities. The Total Return version (“S&P GSCI TR”) includes the return on cash. As an index, the GSCI does not include any management or performance fees, which is not the same basis as the fund’s return. Like Auspice Diversified, it provides exposure to a number of commodities. There are significant differences however. Importantly, the GSCI index is passive, concentrated in energy, and 100% commodities. Auspice Diversified Trust is active long and short, diversified equally across seven sectors, and also trades financial futures. Reference to the GSCI benchmark does not imply that Auspice Diversified Trust will achieve similar performance.

IMPORTANT DISCLAIMERS AND NOTES

Some of the assumptions and opinions contained herein are the view or opinion of the firm and are based on management's analysis of the portfolio performance.

Prior to February 28, 2023, Auspice Diversified Trust was offered via offering memorandum only and this Fund was not a reporting issuer during such prior period. The expenses of the Fund would have been higher during such prior period had the Fund been subject to the additional regulatory requirements applicable to a reporting issuer. Auspice obtained exemptive relief on behalf of the Fund to permit the disclosure of the prior performance data for the Fund for the time period prior to it becoming a reporting issuer.

Commissions, trailing commissions, management fees and expenses may all be associated with investment funds. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

The contents on this website are provided for informational and educational purposes and are not intended to provide specific individual advice including, without limitation, investment, financial, legal, accounting and tax. Please consult with your own professional advisor on your particular circumstances.

Futures trading is speculative and is not suitable for all customers. Past results are not necessarily indicative of future results. This document is for information purposes only and should not be construed as an offer, recommendation or solicitation to conclude a transaction and should not be treated as giving investment advice. Auspice Capital Advisors Ltd. makes no representation or warranty relating to any information herein, which is derived from independent sources. No securities regulatory authority has expressed an opinion about the securities offered herein and it is an offence to claim otherwise. Please read the offering documents before investing.

Certain statements in this document are forward- looking statements, including those identified by the expressions “anticipate”, “believe”, “plan”, “estimate”, “expect”, “intend”, “target”, “seek”, “will” and similar expressions to the extent they relate to the Fund and the Manager. Forward- looking statements are not historical facts but reflect the current expectations of the Fund and the Manager regarding future results or events. Such forward-looking statements reflect the Fund’s and the Manager’s current beliefs and are based on information currently available to them. Forward-looking statements are made with assumptions and involve significant risks and uncertainties. Although the forward-looking statements contained in this document are based upon assumptions that the Fund and the Manager believe to be reasonable, neither the Fund or the Manager can assure investors that actual results will be consistent with these forward-looking statements. As a result, readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results or events to differ materially from current expectations.

The forward-looking statements contained herein were prepared for the purpose of providing prospective investors with general educational background information about the Funds and may not be appropriate for other purposes. Neither the Fund or the Manager assumes any obligation to update or revise them to reflect new events or circumstances, except as required by law.

This blog may contain hypertext links to web sites owned and controlled by other parties than Auspice. We have no control over any third-party-owned web sites or content referred to, accessed by or available on this web site and therefore we do not endorse, sponsor, recommend or otherwise accept any responsibility for such third-party web sites or content or for the availability of such web sites. In particular, we do not accept any liability arising out of any allegation that any third-party-owned content (whether published on this or any other web site) infringes the intellectual property rights of any person, or any liability arising out of any information or opinion contained on such third-party web site or content

[1] https://www.npr.org/sections/goatsandsoda/2023/06/08/1180454049/india-is-now-the-worlds-most-populous-nation-and-thats-not-necessarily-a-bad-thi

[2] https://www.auspicecapital.com/alt-invest/2023/1/4/india-the-emerging-demand-shock-to-further-fuel-the-commodity-supercycle

[3] https://www.auspicecapital.com/alt-invest/2023/2/3/india-part-two-the-surge-in-indian-capex-and-infrastructure-spending

[4] https://www.ft.com/content/460ee3ca-9e54-4cec-9d0b-a9896c007bc9