To download the Auspice October Blog as a PDF, click here.

The Auspice October blog explores why investors should consider return stacking as an evolution in portfolio construction. With equity markets increasingly concentrated and bonds offering less diversification, investors need more efficient ways to strengthen portfolios without sacrificing their core holdings. Once reserved for institutional portfolios, return stacking now expands the tool kit available to retail investors, combining traditional beta and alternative return streams within a single, capital-efficient structure.

Many advisors and direct investors look to introduce alternatives (e.g., 20% allocation) to strengthen portfolio diversification. This is increasingly important given how concentrated equity markets have become.

Today, the “Mag 7” - Alphabet, Amazon, Apple, Broadcom, Meta Platforms, Microsoft and Nvidia make up nearly 33% of the S&P 500's entire value, according to disclosures from Vanguard's $762.3 billion S&P 500 ETF [1]. The combined market cap of the top 20 holdings represented 49% of the S&P 500 as of Sept. 30, compared to about 36% of the index during the comparable dot-com bubble two decades ago. As Amrita Nandakumar, president of Vident Asset Management notes, many investors may not realize that their “diversified” index fund increasingly resembles a highly concentrated tech portfolio [2].

#1 Diversification Without Sacrifice

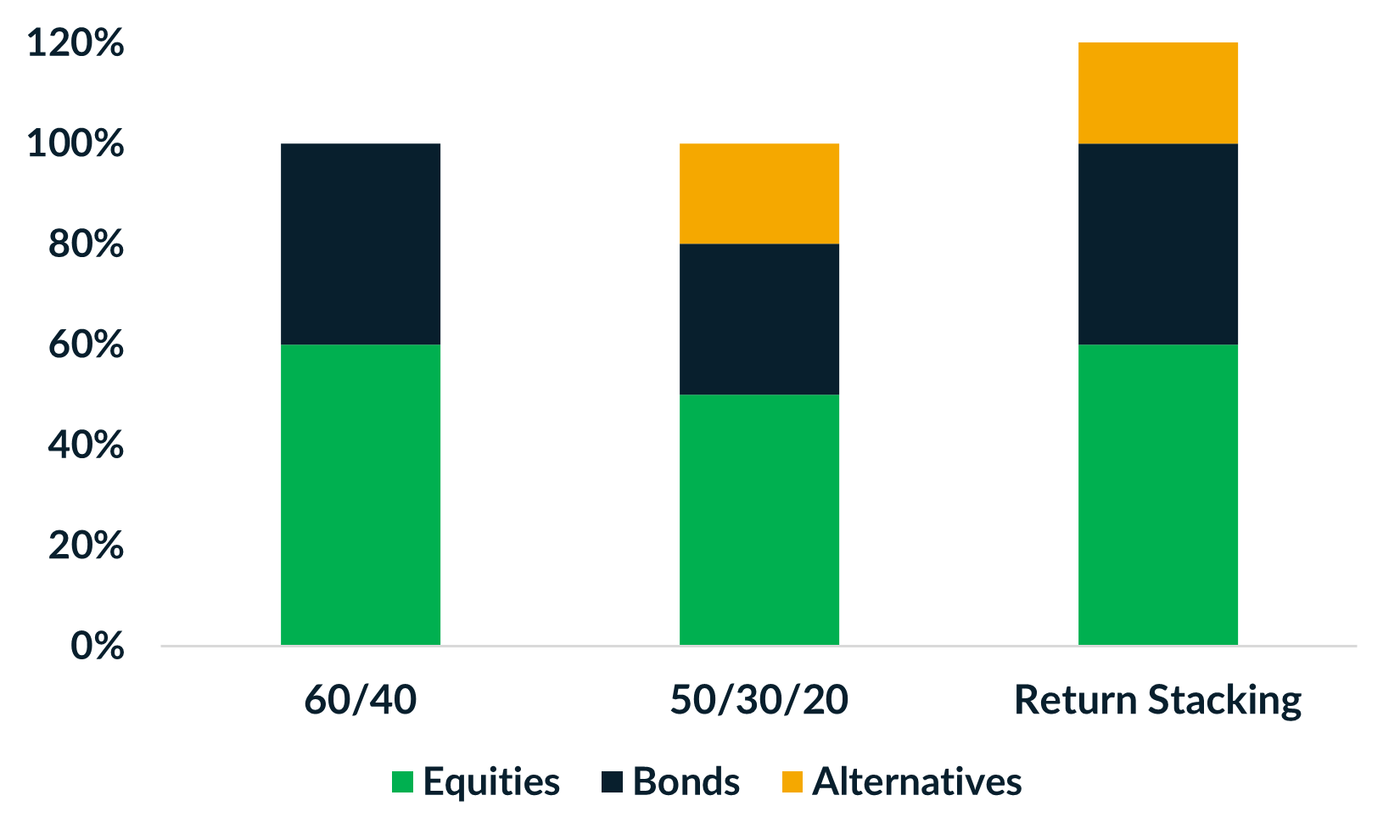

Historically, alternative strategies were confined to separate hedge-fund or diversifier sleeves, sitting on the edge of the portfolio. This has often meant selling down equities and bonds to make room - for example, shifting from a 60/40 mix to a 50/30/20 portfolio as shown in Chart 1.

Chart 1: Evolution of Portfolio Construction

Source: Auspice Capital Advisors

While the approach improves long-term portfolio outcomes mathematically, it often creates short-term behavioral friction, especially during strong equity markets. Clients question the strategy, advisors face uncomfortable comparisons, and the long-term benefits of diversification are often overshadowed by recency bias of short-term equity performance.

Return stacking changes that dynamic by acting as an equity replacement.

Rather than asking clients to carve out their core holdings, advisors can allocate that same 20% to a product that combines equity (or bond) beta exposure and an alternative diversifier within a single investment. This “equity replacement” allows investors to maintain full core exposure while adding an additional uncorrelated return stream, on top – effectively, $2 exposure per each $1 invested.

These alternative strategies can now sit inside the core of a portfolio. This structure, long used by institutional investors as “portable alpha”, now accessible to retail investors via commingled funds, enables them to keep their original asset mix, reducing their opportunity cost, while gaining an additional diversifier - effectively creating 120% total exposure (highlighted in Chart 1) without deploying more capital.

The result is improved potential for stronger long-term, risk-adjusted returns. It allows for the benefits of diversification without the short-term behavioral impacts that often result from reducing core market exposure.

#2 Freeing Up Capital: Portfolio Funding Through Capital Efficiency

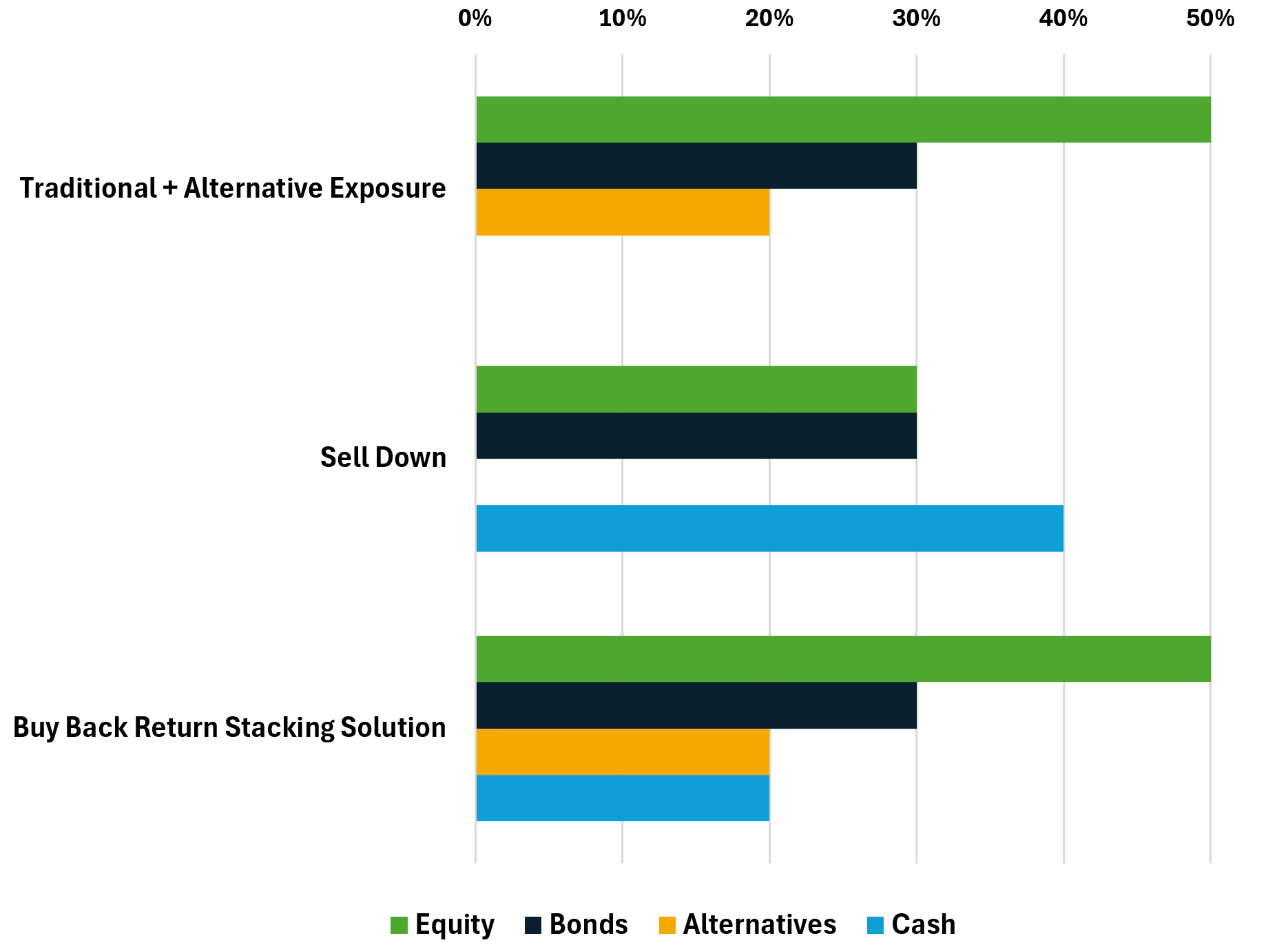

Most professionally managed portfolios already hold diversifiers - such as trend following (CTA/managed futures) or commodity focused mutual funds, fund of funds or ETFs - alongside traditional equity and bond exposures. These strategies have become more popular given the realization that bonds do a poor job of hedging equities in times of normal inflation. Institutional investors have been early adopters in increasing exposures to these strategies substantially. Retail investors share in this demand for higher quality diversifiers but face greater constraints. Without the same flexibility as institutional fund structures, their allocations often tie up valuable capital that could be used elsewhere in the portfolio.

Return stacking introduces the same kind of capital efficiency and structural leverage that institutional investors use within their Total Portfolio frameworks (see the Auspice September blog). By reallocating to a product (See Chart 2) that embeds both equity beta and the diversifier within a single structure, advisors can:

Sell both existing equity and diversifier positions

Buy them back together through one efficient vehicle (to get $2 exposure per $1 invested capital)

Free up capital to either diversify further, hold cash, or pursue new opportunities

Chart 2: Capital Efficiency through Return Stacking Products

Source Auspice Capital Advisors

In practice, this structure also provides the low-cost borrowing and systematic rebalancing that large institutions manage internally with dedicated teams. The result is a more efficient portfolio - fully invested, dynamically balanced, and professionally managed - that mirrors institutional sophistication without the operational burden.

#3 Improving the Client Experience

Beyond improving capital efficiency, return stacking can also create a better experience for clients - both for those focused on core equity exposure and those seeking diversifiers.

Diversifiers such as trend following (managed futures/CTA) often exhibit negative correlation to equities and positive skew (upside volatility/convexity). These characteristics can be highly accretive to equity exposures, typically improving risk-adjusted metrics including Sharpe, drawdown and negative skew (downside volatility).

Shallower drawdowns, stronger recovery profile.

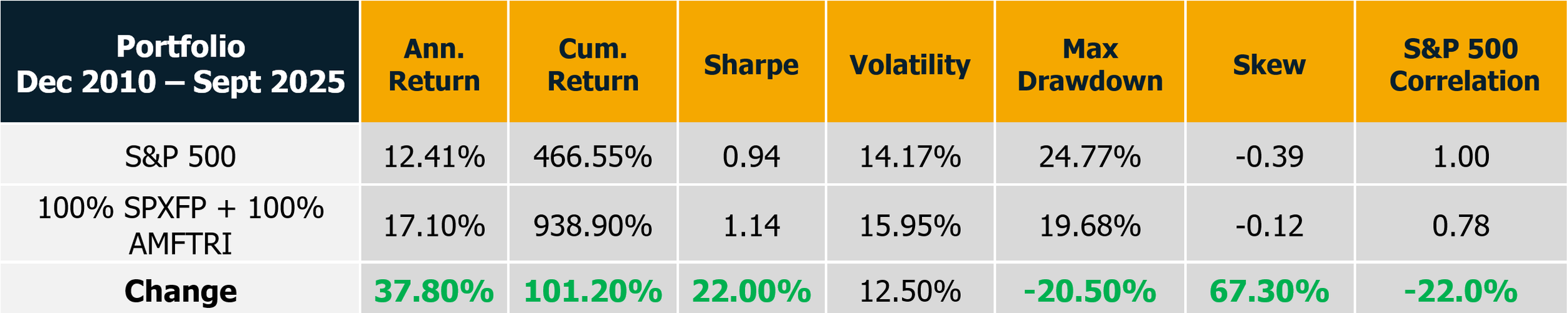

As an example, by combining 100% S&P 500 exposure with 100% exposure to a managed futures index, represented by the Auspice Managed Futures Index (AMFTRI), such a hypothetical portfolio captures growth during equity rallies while historically experiencing smaller peak-to-trough drawdowns than the S&P 500 alone. This can make the investing journey less stressful and improve long-term compounding by limiting deep losses as shown in Table 1.

Table 1: 100% S&P 500 vs 100% SPFX Index + 100% AMFTR

Source: Auspice Capital Operations & Bloomberg – Portfolio Quarterly Rebalanced.

The above “Return Stacking” performance is the hypothetical combination of live indice performance. See important disclaimers at end for more information. You cannot invest directly in an index. Indexes are gross of fees. Past results are not necessarily indicative of future results.

Complementary behavior in equity stress.

Trend following strategies have historically demonstrated complementary performance during equity stress, often providing positive returns when traditional assets decline. Their ability to selectively participate in sustained trends - regardless of market direction - allows them to capture opportunity in both rising and falling markets in the most diversifying asset classes available.

The Auspice Managed Futures Index (AMFTRI) employs momentum and term structure strategies through a quantitative, rules-based methodology. The index tracks long or short positions across a diversified portfolio of exchange-traded futures spanning energy, metals, agriculture, interest rates, and currencies, incorporating dynamic risk management and systematic contract rolling techniques.

Chart 3 below illustrates how managed futures have historically provided positive standalone performance during major equity corrections, highlighting their potential to offset losses when traditional assets struggle. This “crisis alpha” - the ability to profit from extended market dislocations - is a material contributor to the enhanced portfolio outcomes shown in Table 1, driving higher returns and shallower drawdowns per additional unit of risk.

Chart 3: Auspice Managed Futures Total Return Index – Crisis Alpha

Source: Auspice Capital Operations & Bloomberg

The performance of Auspice Managed Futures Index prior to 11/17/2010 is simulated and hypothetical as published by the NYSE. All performance data for all indices assumes the reinvestment of all distributions.

Return Stacking is Not a Hedge, Nor a Panacea

The volatility of 2025, including the “Tariff Tantrum,” underscored both the potential and limitations of return stacking. A sharp selloff followed by a historic reversal in financial and commodity markets created extreme whipsaws that caught many trend-following strategies offside. This period highlighted that return stacking is not immune to short-term setbacks.

However, over complete market cycles it remains a compelling improvement to portfolio construction. For investors seeking greater cash efficiency, broader diversification, and stronger alignment with institutional best practices, return stacking offers a practical and powerful solution.

Other Benefits: Efficient Structure, Tangible Rewards

Canadian Access to a Liquid, Institutional-Style Structure

The Auspice One Fund (fund code ACA301) offers Canadian investors access to a public alternative mutual fund regulated under NI 81-102, combining the liquidity and transparency of traditional mutual funds with the structural advantages typically reserved for institutional portfolios. Investors benefit from daily liquidity, enhanced portfolio diversification, and exposure to both equity beta and managed futures strategies in a single vehicle.

Performance-Fee-Only Diversifier

Unlike conventional funds that charge both management and performance fees, the Auspice One Fund uses a net performance-only fee model. Investors pay only the greater of:

Management fees, or

Performance fees, if the applicable Fund’s series is above its highwater mark.

This means that when the Fund performs well, the management fees are offset against the performance fees –ensuring investors are charged only for net performance, not for overlapping fees.

This structure offers a cost-efficient way to access equity beta and diversifier exposure, with fees directly tied to outcomes. In periods of strong performance, investors effectively pay only for results, aligning manager incentives with investor success.

Quarterly Distribution

The Auspice One Fund’s capital-efficient structure - the same framework used by institutional investors to achieve “two-for-one” exposure - creates room to pay a quarterly cash distribution (subject to market conditions). Because the Fund primarily uses exchange-traded futures to gain its exposures, only a portion of the portfolio’s notional value is required for margin (typically 5–15%), leaving the majority of investor capital available to earn a cash yield.

Together, these features create a uniquely aligned investment experience: full exposure to growth and diversification, access to institutional techniques, and the potential for consistent distributions - all within a single, liquid fund.

If you are seeking commodity exposure - or would like to begin exploring how to incorporate it into your portfolio - email us today at info@auspicecapital.com

SOURCES

[1] https://investor.vanguard.com/investment-products/etfs/profile/voo#portfolio-composition

[2]https://www.ignites.com/c/5007114/696394?referrer_module=searchSubFromIG&highlight=Unprecedented%27%20Top-Heavy%20Indexes%20Drive%20Firms%20to%20Push%20Funds%20That%20Hedge

DEFINITIONS

Indices

Indices and benchmarks are used for comparison purposes only or to illustrate comparisons against other widely used indices or benchmarks most commonly referenced by investors. Index statistics/data are sourced from Bloomberg. You cannot invest directly in an index.

S&P 500 Futures Index (SPXFP) is constructed from the front-quarter E-mini futures contract on the S&P 500. It is part of the S&P Factor Series, which measures the inherent risk premium between asset classes and financial markets.

BTOP50 Index (BTOP 50) – seeks to replicate the overall composition of the managed futures industry with regard to trading style and overall market exposure. For 2025 there are 20 funds in the Barclay BTOP50 Index. The index does not encompass the whole universe of CTAs. The CTAs that comprise the index have submitted their information voluntarily and the performance has not been verified by the index publisher. Total return data is used, which is the same basis as the fund’s return

IMPORTANT DISCLAIMERS AND NOTES

There is a substantial risk of loss in trading futures and options. Past performance is not necessarily indicative of future results.

The hypothetical performance shown is not actual performance. Hypothetical performance has inherent limitations and does not represent actual trading. No representation is being made that any account will or is likely to achieve performance results similar to those shown within this chart. The results are based on simulated or historical data, not actual trading. The hypothetical performance shown does not reflect the deduction of advisory fees, trading commissions or other expenses that would be incurred in an actual account. Other factors, such as market impact, may adversely affect the actual trading results.

Commissions, trailing commissions, management fees and expenses may all be associated with investment funds. Please read the prospectus or applicable offering document before investing. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

These materials are provided for informational and educational purposes and are not intended to provide specific individual advice including, without limitation, investment, financial, legal, accounting and tax. Please consult with your own professional advisor on your particular circumstances.

Futures trading is speculative and is not suitable for all customers. Past results are not necessarily indicative of future results. This document is for information purposes only and should not be construed as an offer, recommendation or solicitation to conclude a transaction and should not be treated as giving investment advice. Auspice Capital Advisors Ltd. (the “Manager” or “Auspice”) makes no representation or warranty relating to any information herein, which is derived from independent sources. No securities regulatory authority has expressed an opinion about the securities offered herein and it is an offence to claim otherwise. Please read the applicable offering documents before investing.

This material may contain forward-looking statements, which were prepared for the purpose of providing general educational background information and may not be appropriate for other purposes. Certain statements in this document are forward- looking statements, including those identified by the expressions “anticipate”, “believe”, “plan”, “estimate”, “expect”, “intend”, “target”, “seek”, “will” and similar expressions to the extent they relate to an Auspice managed investment fund (the “Fund”), where applicable, and the Manager. Forward- looking statements are not purely historical facts but reflect the current expectations of the Fund, where applicable, and the Manager regarding future results or events. Such forward-looking statements reflect the Fund’s, where applicable, and the Manager’s current, reasonable beliefs and are based on information currently available to them. Forward-looking statements are made with assumptions and involve significant risks and uncertainties. Although the forward-looking statements contained in this document are based upon assumptions that the Fund, where applicable, and the Manager believe to be reasonable, neither the Fund, where applicable, or the Manager can assure investors that actual results will be consistent with these forward-looking statements. There is no guarantee that any forward-looking statement will come to pass. As a result, readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results or events to differ materially from current expectations.

Neither the Fund, where applicable, nor the Manager assumes any obligation to update or revise any forward-looking statement to reflect new events or circumstances, except as required by law.

The Manager may present the enclosed information in a blog – such blog may contain hypertext links to web sites owned and controlled by parties other than Auspice. We have no control over any third-party-owned web sites or content referred to, accessed by or available on such web site and therefore we do not endorse, sponsor, recommend or otherwise accept any responsibility for such third-party web sites or content or for the availability of such web sites. In particular, we do not accept any liability arising out of any allegation that any third-party-owned content (whether published on this or any other web site) infringes the intellectual property rights of any person, or any liability arising out of any information or opinion contained on such third-party web site or content.