To download the Auspice January Blog as a PDF, click here.

As the face of Auspice, I get asked all the "why" questions by investors. While I don't always have the answer, I am humbled by the team of talented people I work with, and I can get back with an answer shortly. A personal favorite has been something like, "...we see you are long Oil. Is that because of the storage reports we have read or the refinery utilization. Or perhaps the OPEC+ view?" They want me to give a fundamental narrative.

My answer: “No, the strategy goes long Crude Oil when it is trending higher.”

This question has come up recently regarding Silver and its massive move. A year ago, it came up with Cattle and Coffee. We all want that, a logic or reason underpinning why we do what we do as humans and investors - why is that market up or down. But does it matter?

This blog addresses that topic and how it is related to trend following (or trend capturing as Auspice calls it) - do you want to know Why or When? I also want to put some context around this philosophy for investing, as in life.

In Investing: Why is a Trap. When is the Trade

One of my favorite author's in the investing space, Michael Covel, has covered this topic and puts it very eloquently: Markets don’t owe you an explanation. He is blunt that great traders react rather than predict, making decisions from what has happened instead of what they think will happen. He goes further with the classic point: you don’t need to know why something is down; you need to know what it’s doing and what you’ll do about it.

As such, the practical application for Auspice is that “why” may be interesting and feed our personal needs, but “when” is what matters and the discipline and process we employ to generate non-correlated returns.

When do we enter a market? When do we exit? When do we adjust position sizes? When do we cut risk in a profitable trade? When in an unprofitable trade?

In our view “why” may provide context but confusing it with “when” is a dangerous mistake. One is a narrative, the other is the truth - the market price, not the prediction. Our decision process is the recognition of signal or trend among the noise of price and news, regardless of alignment between narrative and conviction.

We recognize that there are lots of opinions as to what markets are going to do and “why”. As shown in Chart 1, Market fundamentals, opinions and outlooks are simply that - they are at best, hypotheses. The forecast, however smart the author, is not a truth. What is true, undeniably, is the price movement, whether we agree or not. In our opinion, the error or trap is treating the forecast as the trade. We believe and understand there is gratification (we are human!) when the market price moves consistent with views - but it is not required in trend following.

Signal versus Noise

There are so many factors affecting market price, it is hard to understand what is important at any given moment. As such, picking the bottom in markets is as challenging as picking tops. If you wait for a fundamental report, you likely miss the opportunity.

A client of ours said the following - "This last year in particular (2025), has proven that when the macro noise sits above everything, focusing on the signal can be rewarding, proving that active management has an important role.¹" We couldn't agree more. However, we also recognize that you can't eliminate all the noise or time the market perfectly - you can only create a repeatable process to capture signals in the noise and manage the risk.

The trend following and capturing method that Auspice employs has a near 20-year history of participating in markets that are trending up or down and cutting risk when its not. We use a rules-based process to ensure we do not inject our own opinions, hypothesis, or human need for constant gratification or "why" into the process. We just need movement.

Chart 1: Wheat Price (Continuous Front Month Contract) vs Supply-Risk Narratives

Source: Auspice Capital Operations, WSJ, USDA, RealAgriculture

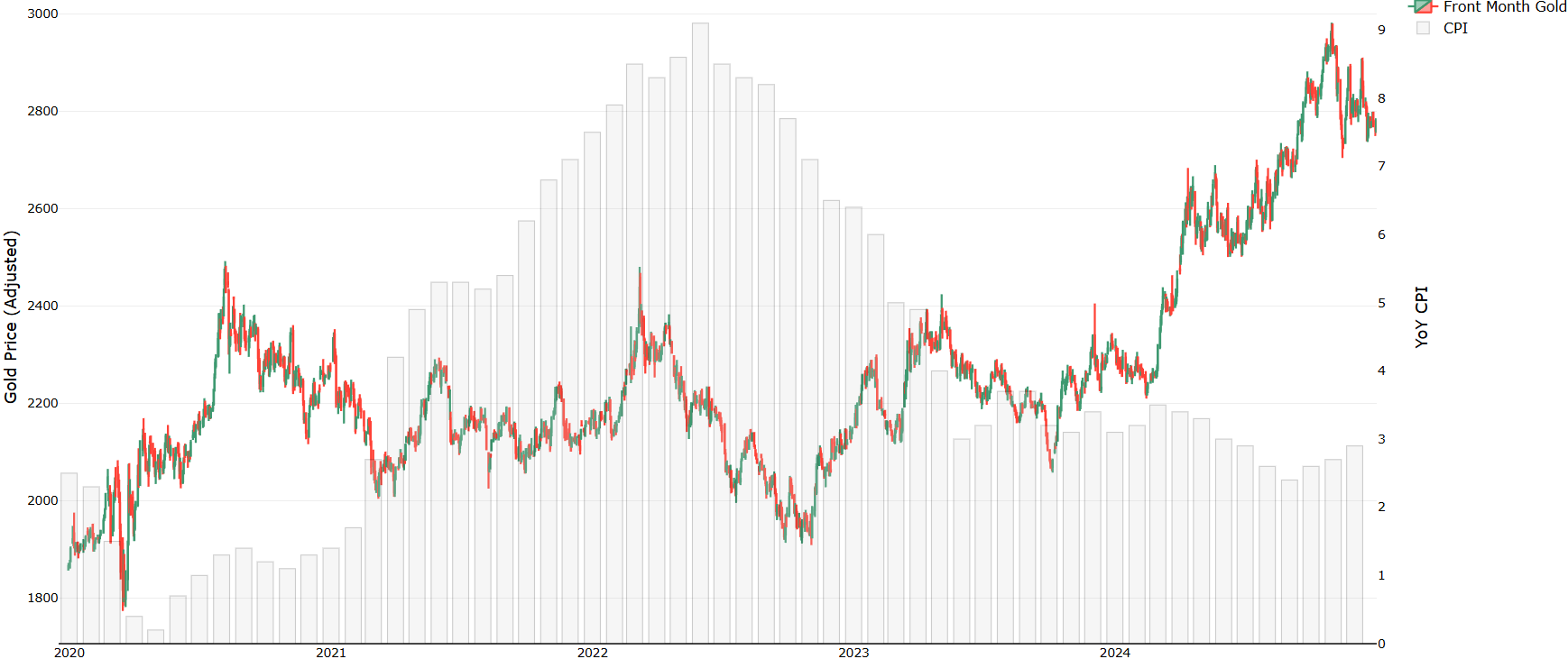

Chart 2: Gold (Continuous Front Month Contract) as Inflation Hedge Narrative

Source: Auspice Capital Operations

As in Life

I often say don't listen to what such and such politician says, look at what they do. The same goes with any person in your life. It is also applicable for our human need to learn and come up with reasons or strategies for how we will conduct our life. We want to know "why" for meaning and learning. Perhaps to avoid repeating mistakes. But "when" is the action - those decisions we need to make without perfect information - and it is seldom we have perfect information in life. If you wait for certainty, the train, with the opportunity along side it, has left the platform.

For the Investor or Allocator

The real question with our investment strategy isn't "why" it works - it is "when does it matter?"

While we are all puzzling the reason the markets are behaving a certain way - recently why Silver and Gold have risen so much, the real question is does it matter? A better question is when did you get long silver and gold.

For Auspice the answer was a long time ago. Our strategies have been in and out of Gold a few times, but overall, we have maintained long exposure during extended trends over the years. Not because we understood exactly why it was moving. In fact, fundamentally it was counterintuitive. Gold didn't move much higher after COVID hit in 2020 and inflation exploded as shown in Chart 2. It didn’t act as the established inflation hedge narrative suggests it should have. In fact, it only started to move after we started to dis-inflate to the long-term 3% CPI average starting in 2023. Maybe it was the rumours of central bank accumulation or ETFs - we don't know nor do we need to. We got long gold because it was moving higher.

Similarly, the strategy moved to long Silver when it started to move higher in mid 2025. Compared to gold it looked cheap for years - so what? It is the same reason we maintained short exposure to natural gas for the better part of the last couple years - because it was trending down - regardless of our long-term bullish outlook fundamentally for our favourite commodity. Same for Cattle and Coffee in 2024 thru mid 2025, the same for Cocoa at Christmas 2024.

Does Auspice use Why?

At Auspice we believe "why" belongs in portfolio construction.

Why are we tilted to commodities, trading a wide range of markets? Because commodities are the most diverse asset class: Cotton is not like Crude oil is not like Canola. It provides the most diverse set of opportunities to find returns that are non-correlated to equities and bonds we all have in our traditional portfolios. Our average commodity exposure (by risk) is 70%+ commodities (Auspice Diversified flagship)- these are decisions we have made at a fundamental level. We believe conditions may resemble those seen in past commodity supercycles driven by fundamental reasons. However, this doesn’t mean that commodities will all move in tandem. While we don't know which commodities will go up or down at any given time, we believe the diverse sector will be volatile and provide unique opportunities for outlier trends - both up and down.

Life

"Life can only be understood backwards; but it must be lived forwards²”

You don't need to know why the fire started to know to get out of a burning house. You don't wait for certainty of falling overboard to wear a lifejacket while canoeing on a river. The trauma surgeon doesn’t ask why the accident happened; they tend to your injuries. In life we prioritize action (when) over explanation (why). The same works in investing using trend following.

Trend following is not about knowing why markets move - it’s about having a disciplined process for when they do. “Why” makes portfolios elegant. “When” focuses on risk management and participation in opportunity.

SOURCES

Stephen Harvey at Sagard Wealth January 25th, 2026

Søren Kierkegaard

IMPORTANT DISCLAIMERS AND NOTES

There is a substantial risk of loss in trading futures and options. Past performance is not necessarily indicative of future results. The views expressed are those of the author and do not constitute investment advice.

Commissions, trailing commissions, management fees and expenses may all be associated with investment funds. Please read the prospectus or applicable offering document before investing. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

These materials are provided for informational and educational purposes and are not intended to provide specific individual advice including, without limitation, investment, financial, legal, accounting and tax. Please consult with your own professional advisor on your particular circumstances.

Futures trading is speculative and is not suitable for all customers. Past results are not necessarily indicative of future results. This document is for information purposes only and should not be construed as an offer, recommendation or solicitation to conclude a transaction and should not be treated as giving investment advice. Auspice Capital Advisors Ltd. (the “Manager” or “Auspice”) makes no representation or warranty relating to any information herein, which is derived from independent sources. No securities regulatory authority has expressed an opinion about the securities offered herein and it is an offence to claim otherwise. Please read the applicable offering documents before investing.

This material may contain forward-looking statements, which were prepared for the purpose of providing general educational background information and may not be appropriate for other purposes. Certain statements in this document are forward- looking statements, including those identified by the expressions “anticipate”, “believe”, “plan”, “estimate”, “expect”, “intend”, “target”, “seek”, “will” and similar expressions to the extent they relate to an Auspice managed investment fund (the “Fund”), where applicable, and the Manager. Forward- looking statements are not purely historical facts but reflect the current expectations of the Fund, where applicable, and the Manager regarding future results or events. Such forward-looking statements reflect the Fund’s, where applicable, and the Manager’s current, reasonable beliefs and are based on information currently available to them. Forward-looking statements are made with assumptions and involve significant risks and uncertainties. Although the forward-looking statements contained in this document are based upon assumptions that the Fund, where applicable, and the Manager believe to be reasonable, neither the Fund, where applicable, or the Manager can assure investors that actual results will be consistent with these forward-looking statements. There is no guarantee that any forward-looking statement will come to pass. As a result, readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results or events to differ materially from current expectations.

Neither the Fund, where applicable, nor the Manager assumes any obligation to update or revise any forward-looking statement to reflect new events or circumstances, except as required by law.

The Manager may present the enclosed information in a blog – such blog may contain hypertext links to web sites owned and controlled by parties other than Auspice. We have no control over any third-party-owned web sites or content referred to, accessed by or available on such web site and therefore we do not endorse, sponsor, recommend or otherwise accept any responsibility for such third-party web sites or content or for the availability of such web sites. In particular, we do not accept any liability arising out of any allegation that any third-party-owned content (whether published on this or any other web site) infringes the intellectual property rights of any person, or any liability arising out of any information or opinion contained on such third-party web site or content.