Download the commentary here.

October continued to be a challenging environment for trend following strategies. While the common reasons for this are obvious: a lack of pervasive trends or moves against established trends, we are experiencing other interesting market behavior. The volatility in the market has been very choppy flipping between “risk on” and “risk off” environments as opposed to volatile and headed in a particular direction. Moreover, we are experiencing high correlation between the diverse asset classes.

SYNOPISIS OF DRAWDOWN ANALYSIS

Managed Futures is typically a difficult strategy to time because of the non-correlated performance that results from the widespread diversification of market sectors covered. One of the best ways to consider an entry point is through an understanding of drawdowns over time. Pullbacks occur in every strategy, however given transparency of the returns, it is intuitive to analyze the character of the pullbacks and subsequent gains with managed futures. These pullbacks generally represent an opportunity from which trends develop and extend. Furthermore, the time to make new gains is often quicker than the length of the pullback (peak to valley).

All of these things have combined recently to cause a challenging environment for the strategy but here is the key thing: this is not uncommon. This has happened historically many times. We most recently experienced this environment in 2006 into late 2007. In this case we were in a similar situation where the equity market had been strong, peaking in October 2007. Performance was a challenge in almost all sectors covered leading to a performance low in the summer of 2007 (August specifically). Out of that period, the strategy gained significantly: 60% from August 2007 to February 2009 while the equity markets moved lower: TSX60 down 38.2% and the S&P dropped 50%. While we do not imply that things will unfold exactly the same, the set-up is very similar, right down to the US election and the equity markets strength beginning to wobble.

For those interested in a copy of an analysis of the drawdown and recovery periods for Auspice Diversified, please contact Auspice. A quick synopsis can be obtained here, which highlights the environment and the opportunity. This is the exact environment to be holding or adding to this type of an investment.

The Auspice Diversified Program was not profitable in any of the 7 sectors traded. The last time this occurred was in July 2007 right before the strategy began a rally up to March 2009.

Interesting Trades:

- Exited a profitable short trade in Cotton that was entered in February.

- Crystallized gains in Gasoline as the rally showed signs of softening.

- Exited a long position in the Nasdaq equity index.

- Covered a Lumber short that was only on for a few days. This was a great move as the lumber market has moved substantially higher and we are now long.

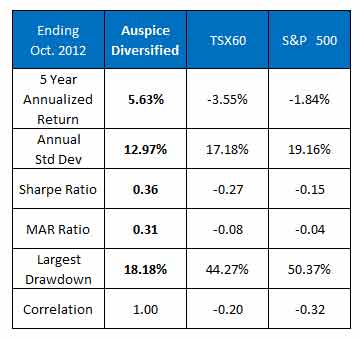

The 5 year statistics (Nov 07 - Oct 12) are: +5.63% annualized return with 12.97% volatility. The worst drawdown for the period is 18.18% with an average Margin to Equity ratio of 6.3%. The global equity markets remain down (-1 to -5% annualized) over this same period with 20-35% more volatility and deep drawdowns of 40-55%. Over the long run, the performance of the Auspice Diversified Program highlights not only the non-correlation and absolute return characteristics of the strategy, but the lower risk profile vs. traditional investments due to stringent risk management and downside protection.

Key Points Regarding our Positions

Energies: As was the case last month, with the exception of Natural Gas, Energies were weak dominated by Crude and Heating Oil. While Heating Oil mustered up a rally in the first part of the month, it followed Crude and Gasoline lower in the last half. We are still short Crude and flat Heat. Natural Gas was sideways and we remain on the sidelines at the moment. Keep a close watch here as we are seeing signs of upside potential. Lastly, we covered the long trade in Gasoline initiated in July for a gain.

For those with specific interest in this sector, please contact Auspice regarding the launch of our Energy focused strategy in collaboration with Pulse Capital Partners. The program went live on March 2nd.

Metals: Metals were universally weak. While we remained on the sidelines in Palladium, we re-entered a short in Copper. This market has been trading a tight range, drifting lower since early 2011. We think a sharper move is overdue. We continue to hold Gold and despite the pullback in October, it looks strong overall.

ADDITIONAL REFERENCES

- Advisor.ca article dispels some of the myths regarding managed futures.

- Listen to a podcast interview with Tim Pickering, President of Auspice and Michael Covel, a leading author specializing in Managed Futures and trend following.

- For those interested in more ideas about investing in alternatives, please check out the www.amfmblog.com.

Grains: Grains were weak across the board in October and we did not make any position changes. We are holding the same long positions in the strongest part of the Grains sector: Corn and Soybeans. Wheat continues to consolidate since July and we remain flat.

Soft Commodities: The Softs sector was active as we repositioned responding to trend validation. As mentioned above, we covered a brief short in Lumber and went long near month end. This will be one to watch alongside the US storm rebuilding efforts. We crystallized a profitable Cotton short and added new shorts in both OJ and Coffee.

Currencies: This sector continues to be challenging highlighting the risk on risk off environment. We remain long the strongest markets in Aussie and Canadian dollar positions but exited a short lived long British Pound position. We continue to be short the Euro but covered the short in the US Dollar Index. We remain on the sidelines in the Yen and Swiss Franc although both a have a slight upwards bias at this time.

Interest Rates: While only producing a small loss on the month, the Interest Rates sector was weaker (higher rates). This is a sector that has been very profitable from the long side for a number of years and we have crystallized most of the gains. We are only holding US 10years, unchanged from September.

Equity Indices: Lastly, we made some changes in the Equity index sector. While most of the global sector was weak, we managed to own one of the stronger markets in Hong Kong’s Hang Seng added early in the month. While we continue to hold long positions in the French CAC 40, the Russell 2000, and the S&P 500, we have begun to reduce risk elsewhere. We have exited the Nasdaq and we are also flat the Nikkei at month end. It appears some of the upside momentum has been lost and we are monitoring this closely.

*Returns repesent the performance of the Auspice Managed Futures LP Series 1.