Market Review

The index has shifted to a long stance in the commodity and financial markets since the end of Q2. The index experienced a small loss in September of -0.22% and the quarter -1.68% while the equity markets were very strong. In general, Q3 and the year has been a challenging one for managed futures as the market has been dominated by a few core trends amidst general choppiness and market interventions. The results of the index remain non-correlated relative to traditional asset classes.

Index Review

The AMFERI was down 0.22%% in September for a loss of 1.68% in Q3. The index is down 3.68% YTD after gaining 8.48% in 2011.

Portfolio Recap

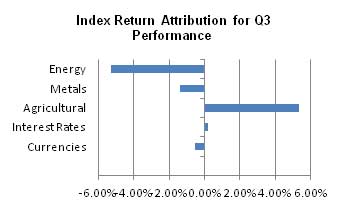

In Q3, the AMFERI index was profitable in 2 of the 5 sectors and negative in 3. The weakest sector within the index was Energy followed by Metals while the strongest was the Agriculture. Interest Rates provided a small gain while Currencies provided a small loss.

The index is currently positioned long in commodities, tilted long in 8 of 12 commodity markets adding 5 new long commodity weights during the quarter. The index is tilted long in financial markets with 7 of the 9 components holding a long weight.

Energy

The Energy sector has shifted from completely short ending Q2 to adding long positions steadily in Q3. First, after experiencing one of the longest downtrends in the commodity history, Natural Gas went long in July. Gasoline followed in August and Heating Oil went long in September. The index is currently short Crude Oil position and this market was the weakest of the sector during September.

Metals

After leaving Q2 short, the index has shifted to long positions in Gold and Silver during September. The index is still short Copper at this time but this will be one to watch.

Agriculture

The Ag sector led the index with gains provided by the Grains during Q3. Each of the Grains added value and remain with long weightings at this time (Corn, Wheat, Soybeans). Most of the gain was made early in the quarter. Sugar was weaker during Q3 and contributed to the sector performance from the short side while Cotton was modestly stronger for a small loss.

Interest Rates

The Index remains long Interest Rate futures across the curve (US 5,10 year Notes and 30 year Bonds). This sector was profitable in Q3.

Currencies

Currencies provided a small loss in Q3 as many of these markets changed position during the quarter and were generally choppy and in transition. The index moved from short to long in the Aussie and Canadian Dollars as well as the Japanese Yen. Significant gains were again made from the long weight in British Pound while the Euro short was not profitable but held. Lastly, the index moved to a short in the US Dollar index as the Dollar showed weakness through the latter half of the quarter.

Outlook

Managed Futures remains an excellent place to be given the current market volatility and risk. While the recent performance has been slightly negative, the correlation to traditional markets remains low. The AMFERI remains an excellent defensive place to get non-correlated performance and crisis protection.

Strategy and Index

The Auspice Managed Futures Index aims to capture upward and downward trends in the commodity and financial markets while carefully managing risk. The index will use a quantitative methodology to track either long or short positions in a diversified portfolio of 21 exchange traded futures which cover the energy, metal, agricultural, interest rate, and currency sectors. The index incorporates dynamic risk management and contract rolling methods. The index is available as either a total return index (includes a collateral return) or as an excess return index (no collateral return).

About the Index Provider

Auspice is an innovative asset manager that specializes in applying formalized investment strategies across a broad range of commodity and financial markets. Auspice’s portfolio managers are seasoned institutional commodity traders. Their experience, trading one of the most volatile asset classes, forms the backbone of their strategy for generating profits while preserving capital and dynamically managing risk.

Auspice Capital Advisors Ltd. is a registered Portfolio Manager / Investment Counsel / Exempt Market Dealer in Canada and a registered Commodity Trading Advisor, pool operator (CTA/CPO) and National Futures Association (NFA) member in the US. Auspice’s core expertise is managing risk and designing and executing systematic trading strategies.

Auspice uses its diverse trading and risk management experience to manage 4 diverse product lines. and has been described as a “next generation CTA”, offering strategies in active managed futures (CTA), passive ETFs, enhanced indices and custom commodity strategies.