Download the commentary here.

The Auspice Diversified Program was down 3.64% in September.

September was a challenging month with strong moves against the established trends. The month was in contrast to the shift that started Q3 that reduced the defensive stance (shorts) and added long positions in many sectors including Energy, Grains, Metals, and Equity Indices.

While we experienced a number of positive trades, these were outweighed by the “risk off” stance that occurred quickly in Grains, Rates and Energies. Most of the trends and positions in these sectors remain intact. The commodity side of the market remains strong overall as indicated by the global long commodity indices that recently showed strength.

The Auspice Diversified Program was profitable in only 1 of the 7 sectors traded with a gain from Metals. The Equities and Softs sectors were near flat. The most challenging sectors were Energies, Interest Rates, Currencies and Grains.

Interesting Trades:

- Reduced long Interest rates exposure – exited US 30 year bonds locking in gains.

- Exited short Copper trade profitably locking in gains.

- Added exposure to Equity Indices as they remain strong.

- Commodity currencies are strong while Euro and USD are weak.

- Gold leads commodities higher and has broken out to the upside. We are long.

- Exited Natural Gas short, added Crude short and continue to hold Gasoline long as energy has been volatile.

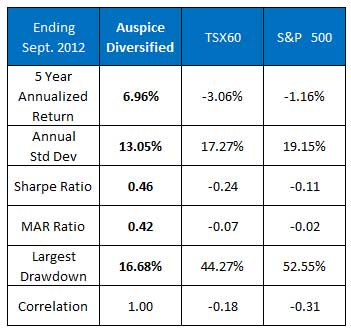

The 5 year statistics (Oct 07 - Sep 12) are: +6.96% annualized return with 13.05% volatility. The worst drawdown for the period is 16.68% with an average Margin to Equity ratio of 6.4%. The global equity markets remain down (-1 to -5% annualized) over this same period with 20-35% more volatility and deep drawdowns of 40-55%. Over the long run, the performance of the Auspice Diversified Program highlights not only the non-correlation and absolute return characteristics of the strategy, but the lower risk profile vs. traditional investments due to stringent risk management and downside protection.

Key Points Regarding our Positions

Energies: With the exception of Natural Gas, Energies were weak dominated by Crude and Heating Oil. We have added a new short to Crude but remain long the strongest part of the sector with Gasoline. The recent new short in Natural Gas has been covered and is now flat. Natural gas is going through transition and should be monitored very closely for opportunity and risk.

For those with specific interest in this sector, please contact Auspice regarding the launch of our Energy focused strategy in collaboration with Pulse Capital Partners. The program went live on March 2nd.

Metals: The Metals sector was profitable with some interesting position gains and changes. The long Gold position that we added in August made great gains during the month. The Gold trade offset losses in a new long position in Palladium that was short lived. Palladium started to fall sharply along with many commodities at mid month and we covered quickly. Lastly, we covered our long standing short in Copper to lock in a gain. At month end, Gold is the only long position within the Metals sector.

ADDITIONAL REFERENCES

- Advisor.ca article dispels some of the myths regarding managed futures.

- Listen to a podcast interview with Tim Pickering, President of Auspice and Michael Covel, a leading author specializing in Managed Futures and trend following.

- For those interested in more ideas about investing in alternatives, please check out the www.amfmblog.com.

Grains: We are holding the same long positions in the strongest part of the Grains sector: Corn and Soybeans. While both of these markets sold off during the month, we are holding the positions as the long term trend remains intact. Wheat remains the laggard and we are flat at this time.

Soft Commodities: As within August, with the exception of Coffee, the Softs markets followed the rest of commodity market – this time it was lower. While we remain short Cotton, we added a short in Lumber near month end. The Coffee market that was shorted in August was covered. We are on the sidelines with OJ at month end. The sector was near flat in September.

Currencies: We have added to the long Aussie and Canadian dollar positions with a British Pound position. We tried the Japanese Yen from the long side but there was little follow through and we reduced the risk. We continue to be short the Euro and added a short in the US Dollar Index. Swiss Franc remains flat. Despite the commodity weakness during the month, it appears that “commodity currencies” are in favor.

Interest Rates: Rates were choppy again as they were in August and we have further reduced the long side risk. We exited US 30 year bonds to only hold a position in US 10 year Notes. This is a big shift from the long exposure that we have profitably held in this sector for the last couple years.

Equity Indices: We continued to add to the long side of the Equity index market in September adding a position in the French CAC 40. This adds to the Russell 2000, S&P 500 and Nasdaq positions already held. The Asian markets remain weaker and we remain flat the Nikkei. We briefly put on a short position in the Hong Kong Hang Seng, but covered quickly as this market showed strength after the first week of the month. At the moment, the Equity sector remains strong in general.

*Returns repesent the performance of the Auspice Managed Futures LP Series 1.