This summer we saw significant dispersion in first half public pension plan returns with notable outperformance from the more diversified, alternative focused plans. Notably, Ontario Teachers’ Pension Plan (OTPP) - with a combined 27% allocation to Commodity Derivatives, Inflation Sensitive Strategies, and Absolute Return - delivered positive first half results whereas many more traditional plans were down high single digit returns.

OTPP, long known as a first mover, had made meaningful attempts to diversify their plan, increasing commodities to 12% of plan while cutting fixed income exposure in half.

“The fund has benefited from our deliberate efforts over the last 12 months to tilt the asset mix towards those that perform well in inflationary environments, particularly commodities and infrastructure.” - Ziad Hindo, OTPP CIO, August 2022.

As investors look to update portfolios this fall many are looking at commodities. Commodities, as investors have been reminded in the last two years, remain one of the few areas investors can find reliable inflation protection and real diversification.

Given the strong run since the lows, some have asked us if they’re too late. In our opinion the answer is a definitive “no”. The 2-year rally since the 2020 lows, while significant in the short term, represents less than a third of the rally experienced in the 1970s. We don’t expect prices to continue their previous straight line up – volatility should be expected – however we remain very constructive on the outlook.

Importantly, 2022 data suggests commodity Capex and corresponding supply continues to be a problem that can’t be fixed quickly.

Increased Tightness in Commodity Supply

Even though the world consumes around 40% more of many major commodities than it did 15 years ago, resource companies have again slashed investment in new production in 2022. See the Energy/Mining Capex chart below.

Source: https://www.mining.com/chart-big-oil-mining-on-capex-strike/ and GMO Quarterly Letter

If we look specifically at the energy supermajors, 2022 capital spending remains 30% below the 2019 level and 60% below the 2010-2016 average. As a result, despite elevated prices, the supermajors production of oil and natural gas continues to fall per Figure 3 below.

Historically this was not the case, with energy Capex tending to move in sync with oil prices. However, in the last year this three-decade long relationship has decoupled with Capex failing to respond to higher oil prices.

Source: Strategas

When decreasing commodity Capex is considered alongside GDP growth over the last two decades, the situation appears even more dire, with 2022 producing lows not experienced since 2003 per adjusted chart below:

Source : https://twitter.com/TaviCosta/status/1517955422996471808

US President Biden has publicly advocated for increased US energy production (in contrast to its highly restrictive regulations). However, OPEC has taken a different public stance, willing to take necessary action in order to support higher energy prices. As per multiple news sources on August 23rd,

“The Organization of the Petroleum Exporting Countries stands ready to reduce production to correct the recent oil price fall driven by poor futures market liquidity and macro-economic fears, which has ignored extremely tight physical crude supply”

In light of the continued deterioration in the fundamental backdrop JPMorgan, in their 2022 Annual Long Term Capital Market Assumptions, noted a “strong if not super cycle with a growing consensus around ESG considerations” and that “capex starvation is likely to constrain commodity supply”.

Their Commodity Event Index attempts to capture producer’ supply constraints and sentiment and recently reached levels not witnessed since the early 2000s.

Consolidation before next leg up?

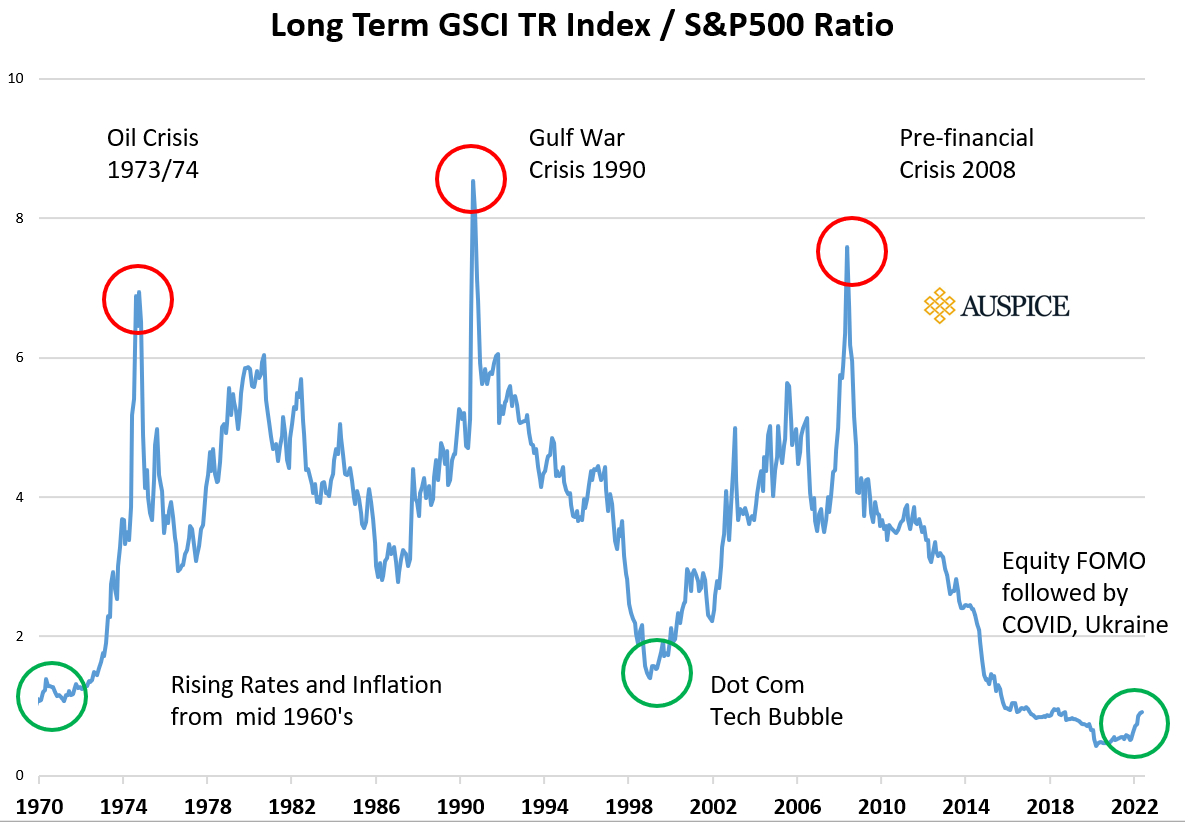

The mid summer bounce in equities and softness in commodities produced the first pullback in commodity to stock outperformance since breaking the previous decade long trend. We believe the pullback may be producing an attractive entry point for investors looking to add commodity exposure.

Source: Bloomberg and Auspice Capital

Long term, both the new uptrend and more recent consolidation represent a small move in the longer-term cycle.

Source: Bloomberg and Auspice Capital

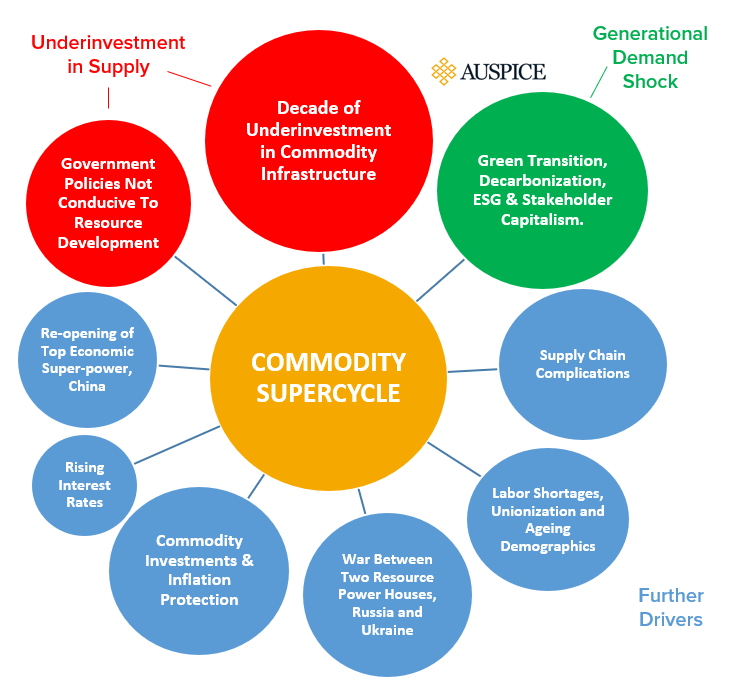

Finally, we’ll conclude with a reminder that the above data points are but a few of the various drivers in what we believe is an emerging commodity supercycle.

Source: Auspice Capital

Commodities outperformed equities for almost 40 years prior to the Global Financial Crisis. Given the continued deterioration in commodity Capex and supply alongside further drivers, we are likely in the early innings of an emerging commodity supercycle.

Source: Bloomberg and Auspice Capital

For more information on Auspice commodity and multi-strategies please email info@auspicecapital.com

Disclaimer below

IMPORTANT DISCLAIMERS AND NOTES

1. The S&P 500 is an index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe. Price Return data is used (not including dividends).

2. The (MSCI) World Index, Morgan Stanley Capital International, is designed to measure equity market performance large and mid-cap equity performance across 23 developed markets countries, covering approximately 85% of the free float-adjusted market capitalization in each. This index offers a broad global equity benchmark, without emerging markets exposure.

3. The S&P Goldman Sachs Commodity Excess Return Index (GSCI TR), is a composite index of commodity sector returns representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities. The GSCI Total Return (“TR”) Index includes the return on cash collateral.

Futures trading is speculative and is not suitable for all customers. Past results are not necessarily indicative of future results. This document is for information purposes only and should not be construed as an offer, recommendation or solicitation to conclude a transaction and should not be treated as giving investment advice. Auspice Capital Advisors Ltd. makes no representation or warranty relating to any information herein, which is derived from independent sources. No securities regulatory authority has expressed an opinion about the securities offered herein and it is an offence to claim otherwise.

QUALIFIED INVESTORS

For U.S. investors, any reference to the Auspice Diversified Strategy or Program, “ADP”, is only available to Qualified Eligible Persons “QEP’s” as defined by CFTC Regulation 4.7.

For Canadian investors, any reference to the Auspice Diversified Strategy or Program, “ADP”, or Auspice One Fund “AOF”, is only available to “Accredited Investors” as defined by CSA NI 45-106.