Last month we talked about the shift in sentiment towards the commodity markets. We are seeing this with both institutional and retail investors. There is a positive view given where we are in the long-term cycle, inflation, global demand, and for portfolio diversification reasons.

We highlighted that timing is hard and as such we advocate adding a tactical commodity sleeve to a diversified portfolio has the potential to improve risk-adjusted returns, regardless of the timing and cycle in commodities.

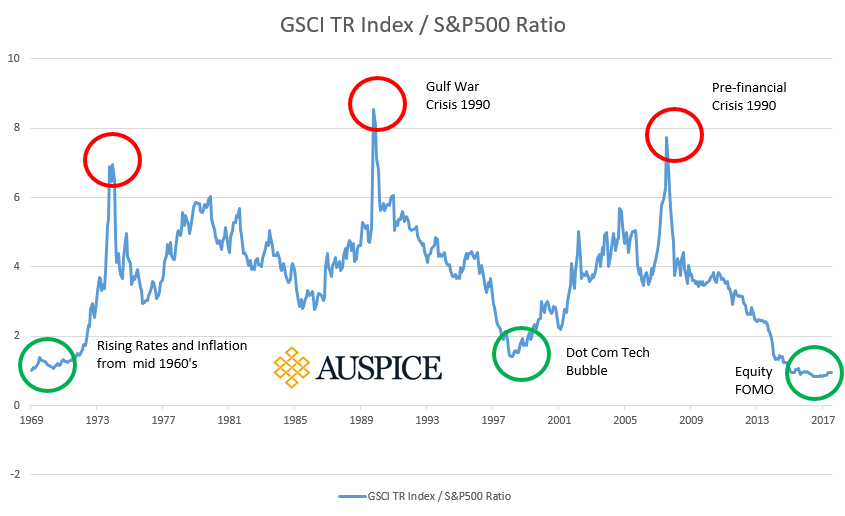

However, what people asked about is indeed the timing aspect and thus we wanted to clarify something: At Auspice we believe the opportunity in commodities is greater than we have seen in almost 10 years. Actually, more like 20, since the late 90’s.

The chart that says it all:

Source: Dr.Torsten Dennin, Incrementum AG

As such, while timing things is hard and we advocate for aiming to build better portfolios, we believe now is the time to be looking at this asset class and importantly the best ways to gain access. We would be happy to help you with this.

For more information on this topic, please refer to the Auspice Commodity white paper on the website under Resources/Research.

For more information, give us a call.

Disclaimer

IMPORTANT DISCLAIMERS AND NOTES

Futures trading is speculative and is not suitable for all customers. Past results is not necessarily indicative of future results. This document is for information purposes only and should not be construed as an offer, recommendation or solicitation to conclude a transaction and should not be treated as giving investment advice. Auspice Capital Advisors Ltd. makes no representation or warranty relating to any information herein, which is derived from independent sources. No securities regulatory authority has expressed an opinion about the securities offered herein and it is an offence to claim otherwise.

COMPARABLE INDICES

Auspice Broad Commodity Excess Return Index (ABCERI): The Auspice Broad Commodity Index aims to capture upward trends in the commodity markets while minimizing risk during downtrends. The index is tactical long strategy that focuses on Momentum and Term Structure to track either long or flat positions in a diversified portfolio of commodity futures which cover the energy, metal, and agricultural sectors. The index incorporates dynamic risk management and contract rolling methods. The index is available in total return (collateralized) and excess return (non-collateralized) versions.

*Returns for Auspice Broad Commodity Excess Return Index or “ABCERI” represent returns calculated and published by the NYSE. The index does not have commissions, management/incentive fees or operating expenses.

The performance of Auspice Broad Commodity Index prior to 9/30/2010 is simulated and hypothetical as published by the NYSE. All performance data for all indices assumes the reinvestment of all distributions. To the extent information for the index for the period prior to its initial calculation date is made available, any such information will be simulated (i.e., calculations of how the index might have performed during that time period if the index had existed). Any comparisons, assertions and conclusions regarding the performance of the index during the time period prior to the initial calculation date will be based on back-testing.

The S&P 500 is an index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe. Price Return data is used (not including dividends).

60-40 Portfolio: 60% investment in SPY (S&P 500), 40% investment in BARCAP US AGG Bond index, rebalanced annually.

BARCAP US AGG Bond: the Bloomberg Barclays US Aggregate Bond Index is a market capitalization-weighted index, meaning the securities in the index are weighted according to the market size of each bond type. Most U.S. traded investment grade bonds are represented. Municipal bonds, and Treasury Inflation-Protected Securities are excluded, due to tax treatment issues. The index includes Treasury securities, Government agency bonds, Mortgage-backed bonds, Corporate bonds, and a small amount of foreign bonds traded in U.S. The Bloomberg Barclays US Aggregate Bond Index is an intermediate term index. The average maturity as of December 31, 2009 was 4.57 years. The Bloomberg Barclays US Aggregate Bond Index, which until August 24, 2016 was called the Barclays Capital Aggregate Bond Index, and which until November 3, 2008 was called the "Lehman Aggregate Bond Index," is a broad base index, maintained by Bloomberg L.P. since August 24, 2016.

QUALIFIED INVESTORS

For U.S. investors, any reference to the Auspice Diversified Strategy or Program, “ADP”, is only available to Qualified Eligible Persons “QEP’s” as defined by CFTC Regulation 4.7.

For Canadian investors, any reference to the Auspice Diversified Strategy or Program, “ADP”, is only available to “Accredited Investors” as defined by CSA NI 45-106.