Auspice Managed Futures Excess Return Index (AMFERI)

Market Review

The AMFERI has continued a profitable run in 2013 with a gain of 0.55% in May. This comes despite the market focus on the equity sector which is not part of this single strategy index. While global equity continued its charge higher, interest rates reversed and bond futures fell hard on the month. However, opportunity continued to be found in Metals and Energies as these markets softened. Lastly, the move to USD currency was significant recently and this has been captured within the trend following approach employed in the Auspice index. The portfolio composition and agility is a central feature of the strategy and a number of changes occurred during the month to adapt to ever changing risks and opportunities as highlighted below.

Core allocation: It is important to recognize the value of the managed futures sector is to provide long term absolute return, asset diversification and non-correlation. Given the overall market environment has been very good, especially the performance of the traditional equity and fixed income sectors in the last couple years, managed futures remains an excellent addition to diversify an investment portfolio. The AMFERI is a low cost and transparent ways to get this important exposure

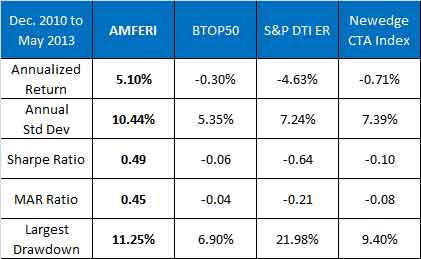

As seen in the next table, the performance of AMFERI versus both investable and non-investable managed futures indices has been good. Since the launch of the index in December 2010, AMFERI continues outperform on both an absolute and risk-adjusted basis.

After a period of challenge for many managed futures strategies, the index is off to a strong start in 2013 making back a significant part of the recent modest drawdown. Pullbacks happen within all strategies; however with managed futures such drawdowns can be an opportune time for investors. Investors should consider the drawdown history of their preferred strategy and gain expectations for potential payoff on recovery and extension.

For those interested in a copy of an analysis of the drawdown and recovery periods for AMFERI, please contact Auspice. See synopsis below.

SYNOPISIS OF DRAWDOWN ANALYSIS

Managed Futures is typically a difficult strategy to time because of the non-correlated performance that results from the widespread diversification of market sectors covered. One of the best ways to consider an entry point is through an understanding of drawdowns over time. Pullbacks occur in every strategy, however given transparency of the returns, it is intuitive to analyze the character of the pullbacks and subsequent gains with managed futures. These pullbacks generally represent an opportunity from which trends develop and extend. Furthermore, the time to make new gains is often quicker than the length of the pullback (peak to valley).

Please contact us at info@auspicecapital.com for the complete analysis.

Index Review

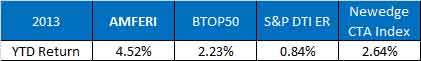

The AMFERI was up 0.55% in May and is up 4.52% in 2013, outperforming a number of investable and non-investable CTA indices highlighted in the table below. As a single strategy CTA index, this strategy provides the benefits of traditional CTA through trend following and agility along with the benefits of transparency and third party publishing, monitoring and benchmarking.

Portfolio Recap:

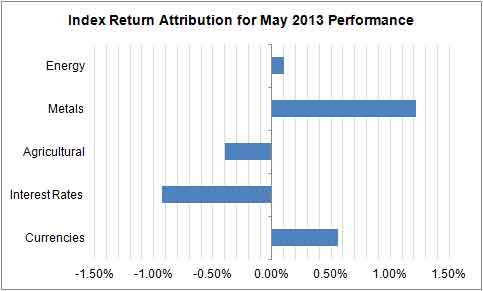

In May the index was up in 3 of the 5 sectors. The strongest sector was again Metals. The top performing components within the index were shorts in Gold and Silver complimented by Wheat, Soybeans and Sugar. Gains were made with both long and short positions and both in commodities and financial markets. The most challenging sector was Interest Rates as bonds corrected sharply lower. The index is currently positioned short in 9 of 12 commodity markets reducing one short position. The index is now tilted short in the financial markets with 6 of the 9 components holding a short weight. Within Financials, Currencies are now positioned short versus the USD adding a new short in May. Interest rate components are mixed with a move to short in 2 of the 3 markets as the price trends lower.

Energy

There were no position changes in energy as the petroleum weights remain short (Gasoline, Heating Oil and Crude Oil while long Natural Gas. While Natural Gas moved lower on the month against the position, the rest of the sector was off adding value to the sector for a net gain.

The Energy sector remains choppy with an overall negative bias to trend in the petroleum components.

Metals

The Metals sector remains short and again benefitted from the significant weakness in Gold and Silver. While the strategy is short Copper which moved higher, this was offset by the gains made. Metals were the most significant attribution to the portfolio gains in May.

Agriculture

With the exception of Cotton, the Ags did very well in May. Led by a short in Wheat, the reversal and new long position in Soybeans were profitable. While Corn rallied modestly against its short, Sugar continued its long term deterioration and the short benefitted. The bulk of the sector loss came from long Cotton which moved significantly lower and will be one to watch closely.

Interest Rates

Rates have been challenging in 2013 as the markets gyrate looking for long term direction. The strategy has shifted from long to short a number of times, common during transition in trends while often at the short term expense of return. This choppy price action and position changing has a cost but can be viewed as tactical jockeying while disciplined trend following and risk management is employed. The components have moved back to be tilted short to take advantage of higher interest rates (short bonds) in 2 of the 3 markets as the momentum shifted to lower bond prices. The index switched to short both US 5 year Notes and 30 year long bonds while currently remaining long 10 year Notes.

Currencies

Currencies were profitable in May as most trended lower against the US Dollar. The index has shifted to short the Aussie dollar in addition to existing shorts in Yen, Canadian dollar, British Pound. The index remains long US Dollar Index and the Euro.

Outlook

The AMFERI is making gains in 2013 alongside the equity market despite the specific lack of equity exposure in the portfolio. In fact there is a negative correlation to the markets despite both being positive on the year. Consider this fact as one looks for opportunities to reduce portfolio risk given the traditional markets have performed well in the last couple of years.

While the broad equity market ended higher in May, the ability to generate returns outside of this sole sector should be recognized and considered. While we don’t have crystal ball, consider ways to protect the portfolio as cracks start to appear in traditional asset classes and alternatives. Managed Futures and the AMFERI are a transparent and cost effective way to add non-correlation and portfolio protection, while still having absolute return from tactical exposures as we saw in May through our shorts in Metals, Energies and Currencies.

Strategy and Index

The Auspice Managed Futures Index aims to capture upward and downward trends in the commodity and financial markets while carefully managing risk. The index will use a quantitative methodology to track either long or short positions in a diversified portfolio of 21 exchange traded futures which cover the energy, metal, agricultural, interest rate, and currency sectors. The index incorporates dynamic risk management and contract rolling methods. The index is available as either a total return index (includes a collateral return) or as an excess return index (no collateral return).

About the Index Provider

Auspice is an innovative asset manager that specializes in applying formalized investment strategies across a broad range of commodity and financial markets. Auspice’s portfolio managers are seasoned institutional commodity traders. Their experience, trading one of the most volatile asset classes, forms the backbone of their strategy for generating profits while preserving capital and dynamically managing risk. Auspice Capital Advisors Ltd. is a registered Portfolio Manager / Investment Fund Manager/ Exempt Market Dealer in Canada and a registered Commodity Trading Advisor (CTA) and National Futures Association (NFA) member in the US.

Auspice’s core expertise is managing risk and designing and executing systematic trading strategies. Auspice uses its diverse trading and risk management experience to manage 4 diverse product lines. and has been described as a “next generation CTA”, offering strategies in active managed futures (CTA), passive ETFs, enhanced indices and custom commodity strategies.

There were no position changes in energy as the petroleum weights remain short (Gasoline, Heating Oil and Crude Oil while long Natural Gas. While Natural Gas moved lower on the month against the position, the rest of the sector was off adding value to the sector for a net gain.

The Energy sector remains choppy with an overall negative bias to trend in the petroleum components.

Metals

The Metals sector remains short and again benefitted from the significant weakness in Gold and Silver. While the strategy is short Copper which moved higher, this was offset by the gains made. Metals were the most significant attribution to the portfolio gains in May.

Agriculture

With the exception of Cotton, the Ags did very well in May. Led by a short in Wheat, the reversal and new long position in Soybeans were profitable. While Corn rallied modestly against its short, Sugar continued its long term deterioration and the short benefitted. The bulk of the sector loss came from long Cotton which moved significantly lower and will be one to watch closely.

Interest Rates

Rates have been challenging in 2013 as the markets gyrate looking for long term direction. The strategy has shifted from long to short a number of times, common during transition in trends while often at the short term expense of return. This choppy price action and position changing has a cost but can be viewed as tactical jockeying while disciplined trend following and risk management is employed. The components have moved back to be tilted short to take advantage of higher interest rates (short bonds) in 2 of the 3 markets as the momentum shifted to lower bond prices. The index switched to short both US 5 year Notes and 30 year long bonds while currently remaining long 10 year Notes.

Currencies

Currencies were profitable in May as most trended lower against the US Dollar. The index has shifted to short the Aussie dollar in addition to existing shorts in Yen, Canadian dollar, British Pound. The index remains long US Dollar Index and the Euro.

Outlook

The AMFERI is making gains in 2013 alongside the equity market despite the specific lack of equity exposure in the portfolio. In fact there is a negative correlation to the markets despite both being positive on the year. Consider this fact as one looks for opportunities to reduce portfolio risk given the traditional markets have performed well in the last couple of years.

While the broad equity market ended higher in May, the ability to generate returns outside of this sole sector should be recognized and considered. While we don’t have crystal ball, consider ways to protect the portfolio as cracks start to appear in traditional asset classes and alternatives. Managed Futures and the AMFERI are a transparent and cost effective way to add non-correlation and portfolio protection, while still having absolute return from tactical exposures as we saw in May through our shorts in Metals, Energies and Currencies.

Strategy and Index

The Auspice Managed Futures Index aims to capture upward and downward trends in the commodity and financial markets while carefully managing risk. The index will use a quantitative methodology to track either long or short positions in a diversified portfolio of 21 exchange traded futures which cover the energy, metal, agricultural, interest rate, and currency sectors. The index incorporates dynamic risk management and contract rolling methods. The index is available as either a total return index (includes a collateral return) or as an excess return index (no collateral return).

About the Index Provider

Auspice is an innovative asset manager that specializes in applying formalized investment strategies across a broad range of commodity and financial markets. Auspice’s portfolio managers are seasoned institutional commodity traders. Their experience, trading one of the most volatile asset classes, forms the backbone of their strategy for generating profits while preserving capital and dynamically managing risk. Auspice Capital Advisors Ltd. is a registered Portfolio Manager / Investment Fund Manager/ Exempt Market Dealer in Canada and a registered Commodity Trading Advisor (CTA) and National Futures Association (NFA) member in the US.

Auspice’s core expertise is managing risk and designing and executing systematic trading strategies. Auspice uses its diverse trading and risk management experience to manage 4 diverse product lines. and has been described as a “next generation CTA”, offering strategies in active managed futures (CTA), passive ETFs, enhanced indices and custom commodity strategies.