Download the Commentary here.

The Auspice Diversified Program was up 0.40% in January.

January continued to provide opportunity in a number of sectors and not just in the obvious Equity market as participants appear to be comfortable that the “Fiscal Cliff” has been averted. While we are not sure about that thesis, we are happy to follow the trends that can be generated by policy. Moreover, it is important to point out that policy and central bank intervention does not always cause the choppiness that we have experienced over the past few years. Historically, trend can be inspired by these “decisions” and if agile enough, captured which remains the goal at Auspice. During the month, this theme was illustrated as we crystallized positions in both Interest Rates futures and Lumber.

SYNOPISIS OF DRAWDOWN ANALYSIS

Managed Futures is typically a difficult strategy to time because of the non-correlated performance that results from the widespread diversification of market sectors covered. One of the best ways to consider an entry point is through an understanding of drawdowns over time. Pullbacks occur in every strategy, however given transparency of the returns, it is intuitive to analyze the character of the pullbacks and subsequent gains with managed futures. These pullbacks generally represent an opportunity from which trends develop and extend. Furthermore, the time to make new gains is often quicker than the length of the pullback (peak to valley).

For those interested in a copy of an analysis of the drawdown and recovery periods for Auspice Diversified, please contact Auspice. A quick synopsis can be obtained here (right), which highlights the environment and the opportunity. The current environment is an opportune time to be adding to this type of an investment.

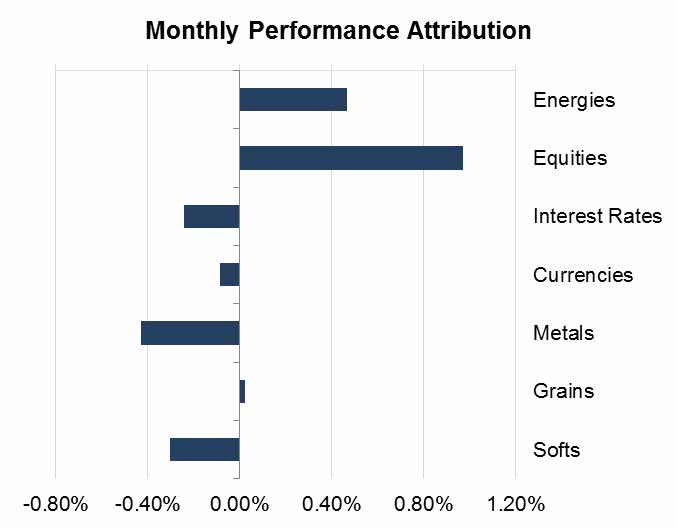

The Auspice Diversified Program was profitable in 3 of the 7 sectors traded. The strongest market was Equity indices as equities shot up in January closely followed by Energies and to a small degree Grains.

Interesting Trades:

- Crystallized long US 10 year Notes held since March 2011 at 10x risk.

- Crystallized long Lumber trade held since October 2012 at over 3x risk.

- New long in Heating Oil while exited short in Crude Oil on Energy strength outside of Natural Gas.

- Continued gains from short Japanese Yen while being long the Nikkei stock index.

- Exited long in Gold and entered a new long in Palladium.

- New long in Corn.

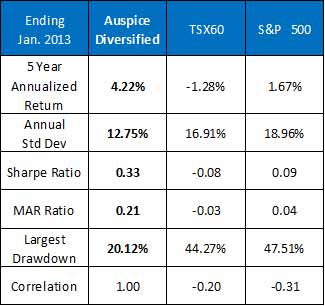

The 5 year statistics (Feb 08 - Jan 13) are: +4.22% annualized return with 12.75% volatility. The worst drawdown for the period is 20.12% with an average Margin to Equity ratio of 6.27%. It should be noted that during this 5 year period, Auspice Diversified remains ahead of the benchmark industry index. The Newedge CTA index is +1.81% annualized over the same period.

The global equity markets remain down to small positive (-5% to +2% annualized range) over this same period with 20-35% more volatility and deeper drawdowns of 40-55%. Over the long run, the performance of the Auspice Diversified Program highlights not only the non-correlation and absolute return characteristics of the strategy, but the lower risk profile vs. traditional investments due to stringent risk management and downside protection.

Key Points Regarding our Positions

Energies: The sector was profitable led by long positions in Gasoline and new long in Heating Oil. We exited our short in Crude Oil to be flat. Crude and Natural Gas remains laggards in this sector but are ones to watch very closely. Energy is long overdue for trending behavior.

For those with specific interest in this sector, please contact Auspice regarding the launch of our Energy focused strategy. The program went live on March 2nd, 2012.

Metals: Metals have continued to be choppy with Gold and Copper lacking trend for some time. We remain out of Copper and exited Gold in January. However, after similar choppy action, Palladium was added and moved sharply higher during the month. Always one to be aware of, this market can provide explosive trends that we have been successful in capturing in the past.

ADDITIONAL REFERENCES

- A recent article in Advisors Edge dispels some of the myths regarding Managed Futures.

- For those interested, Michael Covel, a leading author specializing in Managed Futures and trend following, interviewed Tim Pickering on his background and the unique aspects that make Auspice a Next Generation CTA. Listento the podcast through iTunes.

- Additionally, for those interested in more ideas about investing in alternatives, please check out www.amfmblog.com.

Grains: Grains eked out a small gain after getting beat up since last summer, While Wheat continued this path much of the month, Soybeans and Corn are stronger at month end. We have added a new long position in Corn. By our definition, with the exception of Wheat, the Grains remain in up trend.

Soft Commodities: The Softs sector was negative on the month primarily on profits taken in long term successful trades. We exited the Coffee short for a small gain, and exited the long Lumber position for a solid win. Cotton has continued to show strength and has potential in the short term for a long trade while OJ remains choppy and uninspired.

Currencies: The Currencies sector had some great gains but was offset by losses as we changed direction in certain markets. Gains were led by trades we hold short in Japanese Yen and long Aussie dollar. However, we exited the long positions in British Pound, Canadian Dollar, and Swiss Franc. The Euro was added late in the month as this market shows strength and was immediately profitable. We remain on the sidelines in US Dollar index.

Interest Rates: Big shift in Interest Rates as we exited both US 30 years Bonds and 10 year Notes. The 10 year is one of the best trades in recent years returning 10 times the capital risked, We are not holding any rate positions at this time.

Equity Indices: The star of the month was the Equity sector which has been profitable the last 3 months. The sector moved higher led by continued gains domestically in the S&P and Russell in addition to the Japanese Nikkei index, CAC 40 and Hang Seng. After the first of the month, the Nasdaq did not follow the same trajectory.

As mentioned on the opening statement, we are happy to jump on these Equity trends whether we believe in them or not. However, most critical is the ability to crystallize the gains and capture the trends as change.

*Returns repesent the performance of the Auspice Managed Futures LP Series 1.