Market Review

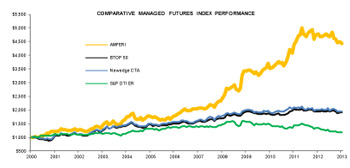

While it has been a challenging quarter and year in the managed futures sector, the AMFERI has managed to remain low volatility and drawdown relative to its peers and the overall equity market while outperforming many.

As the equity and fixed income markets have performed well in the last few years, the managed futures sector has been challenged by the market environment.

First there are a number of factors that have caused the “risk on” and “risk off” market behavior in 2012: speculation re China growth, the US election, the so called “Fiscal Cliff”, and many others. While each of these things may have contributed to choppy market action (as opposed to volatile and headed in a particular direction), there have been gains made and trends captured. Financial markets have been opportune this quarter and perhaps show a sign that markets are starting to normalize. Now that the “Fiscal Cliff” is behind us, we anticipate the disparate asset classes that provide the unique opportunity in managed futures will yet again show their diversification benefits.

As a result, managed futures remain an important sector to include in a portfolio and this is being recognized by many. In a recent article regarding institutional investors (highlighted on our blog here), it was highlighted that:

- "Year on year, more investors are adding CTAs (managed futures) to their portfolios of alternative asset funds in order to tap into this diversified liquid source of alpha.

- “….more assets have gone to CTAs than any other hedge fund strategies since 2008.”

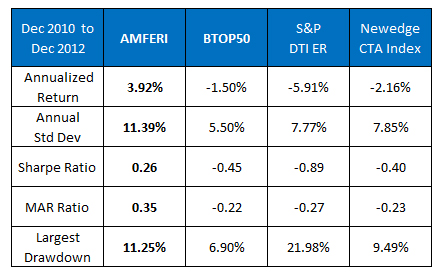

The performance of AMFERI versus both investable and non-investable managed futures indices has been good. Since the launch of the index in December 2010, AMFERI continues outperform on both an absolute and risk-adjusted basis.

As previously highlighted, pullbacks happen within all strategies; however with managed futures such drawdowns can be an opportune time for investors. Investors should consider the drawdown history of their preferred strategy and gain expectations for potential payoff on recovery and extension.

SYNOPISIS OF DRAWDOWN ANALYSIS

Managed Futures is typically a difficult strategy to time because of the non-correlated performance that results from the widespread diversification of market sectors covered. One of the best ways to consider an entry point is through an understanding of drawdowns over time. Pullbacks occur in every strategy, however given transparency of the returns, it is intuitive to analyze the character of the pullbacks and subsequent gains with managed futures. These pullbacks generally represent an opportunity from which trends develop and extend. Furthermore, the time to make new gains is often quicker than the length of the pullback (peak to valley).

Please contact us at info@auspicecapital.com for the complete analysis.

For those interested in a copy of an analysis of the drawdown and recovery periods for AMFERI, please contact Auspice. See synopsis at below.

Index Review

The AMFERI was down 1.38% in December for a loss of 3.92% in Q4 and a loss of 7.45% YTD after it gained 8.48% in 2011. The worst drawdown was 8.38%. By comparison the S&P DTI ER was down 11.26% with a worst drawdown of 11.09%. The strategy continues to have a non- correlation to the stock market: +0.12 to S&P500 in 2012, while slightly negative longer term, -0.28 over 5 year highlighting the crisis protection performance.

Portfolio Recap:

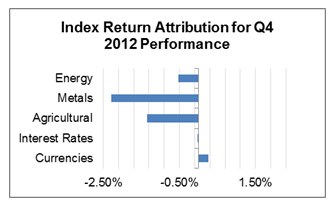

In December and throughout Q4, the strongest sectors were the Financials led by Currencies.

The most challenging sectors were in commodities with Metals and Ags providing the bulk of the index softening. The index is currently positioned long in 7 of 12 commodity markets, having flipped to short in Corn and Wheat late in December. The index also remains tilted long in financial markets with 7 of the 9 components holding a long weight. Within Financials, Currencies have now tilted long adding a long Euro weight during the quarter. Interest rates components remain all long.

Energy

After adding Energy commodities steadily in Q3, there were no changes in Q4. The index ended the quarter long Natural Gas, Gasoline, and Heating Oil and short Crude Oil. After lacking direction and overall softer during the quarter, the year ended with the petroleum markets slightly stronger. Natural Gas was the outlier and weak. Watch for changes in weightings early in the New Year as clouds lift from the US election and the “Fiscal Cliff”.

Metals

The index holds the same long positions in Gold and Silver added late in Q3 while remaining short Copper. The Metals sector was soft in Q4 for the majority of the overall index loss with Copper not able to offset the downside in Gold and Silver.

Agriculture

The Ag sector struggled led by the Grains during Q4. The index exited long weightings in Wheat and Corn during the quarter to minimize further downside and participate in the trend lower from the short side. The index remains long Soybeans. The weakest of the Grains was Wheat which after flipping to a short weight actually helped get the Ags to a positive return in December alone. Sugar was weaker during Q4 and the index remains short for a gain while Cotton was modestly stronger and added a long weight early in the quarter.

Interest Rates

The Index remains long Interest Rate futures across the curve (US 5, 10 year Notes and 30 year Bonds) and was near flat performance in Q4.

Currencies

Currencies led sector gains in December and during the quarter. The most significant gain came from the short in Japanese Yen. Other gains came from long British Pound and short US Dollar Index. The sector is now long Aussie, Canadian Dollar, Euro and British Pound while short Yen, Euro and the US Dollar Index.

Outlook

Given the overall market environment, especially the performance of the traditional sectors over the last couple years, Managed Futures remains an excellent addition to diversify an investment portfolio. While the choppy environment and high sector correlation of the last 2 years has been a challenge for the strategy, it is within expectation and should be expected in order to provide the long term benefits of absolute return, asset diversification, and non-correlation. The AMFERI remains an excellent way to get non-correlated performance and crisis protection in a transparent and liquid way.

Strategy and Index

The Auspice Managed Futures Index aims to capture upward and downward trends in the commodity and financial markets while carefully managing risk. The index will use a quantitative methodology to track either long or short positions in a diversified portfolio of 21 exchange traded futures which cover the energy, metal, agricultural, interest rate, and currency sectors. The index incorporates dynamic risk management and contract rolling methods. The index is available as either a total return index (includes a collateral return) or as an excess return index (no collateral return).

About the Index Provider

Auspice is an innovative asset manager that specializes in applying formalized investment strategies across a broad range of commodity and financial markets. Auspice’s portfolio managers are seasoned institutional commodity traders. Their experience, trading one of the most volatile asset classes, forms the backbone of their strategy for generating profits while preserving capital and dynamically managing risk.

Auspice Capital Advisors Ltd. is a registered Portfolio Manager / Investment Counsel / Exempt Market Dealer in Canada and a registered Commodity Trading Advisor, pool operator (CTA) and National Futures Association (NFA) member in the US. Auspice’s core expertise is managing risk and designing and executing systematic trading strategies.

Auspice uses its diverse trading and risk management experience to manage 4 diverse product lines. and has been described as a “next generation CTA”, offering strategies in active managed futures (CTA), passive ETFs, enhanced indices and custom commodity strategies.