COMMODITY INDICES

The Auspice Commodity Indices capture the risk and return profiles of unique commodity markets such Canadian Natural Gas and Canadian Crude Oil. They represent investable benchmarks in commodities that were previously inaccessible to retail investors.

CANADIAN CRUDE INDEXTM

The CCI™ represents a simple, transparent and liquid benchmark for oil that is produced in Canada.

KEY POINTS ABOUT THE CCITM

- Priced in USD per barrel.

- It accurately reflects the commodity price, risk and volatility of Canadian oil.

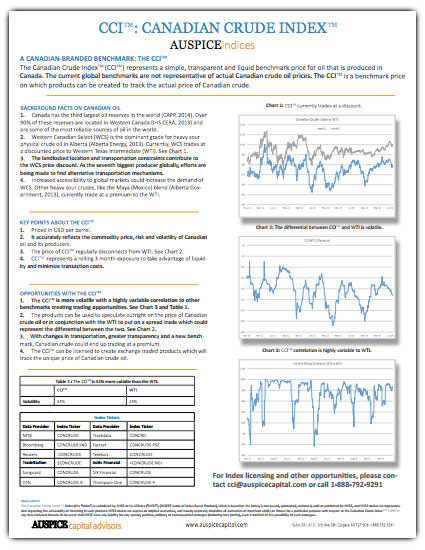

- The price of CCI™ regularly disconnects from WTI. See Chart X.

- CCI™ represents a rolling 3 month exposure to take advantage of liquidity and minimize transaction costs.

| CCITM Reference Price | |

|---|---|

| 39.07 | 1.28 |

| Ticker | CDNCRUDE |

The CCI™ Reference Price represents the fixed price in USD for the contracts that contribute to the index (see holdings below).

| CCITM Excess Return Index | ||

|---|---|---|

| 1015.1 ↑ | +2.0% |

| Ticker | CCIER |

The CCI™ Excess Return Index reflects the returns that an investor would expect to receive if they held the contracts that make up the CCI™ Reference Price and rebalanced them each day.

| Current CCITM Holdings | ||

|---|---|---|

| Month | Price | Weight |

| JAN | $80.72 | 27.8% |

| FEB | $81.03 | 27.8% |

| MAR | $81.60 | 27.8% |

| APR | $82.07 | 16.7% |

| CDNCRUDE | $81.76 | 100% |

ABOUT CANADIAN OIL

- Canada has the third largest oil reserves in the world (CAPP, 2014). Over 90% of these reserves are located in Western Canada (IHS CERA, 2013) and are some of the most reliable sources of oil in the world.

- Western Canadian Select (WCS) is the dominant grade for heavy sour physical crude oil in Alberta (Alberta Energy, 2013). Currently, WCS trades at a discounted price to Western Texas Intermediate (WTI). See Chart 1.

- The landlocked location and transportation constraints contribute to the WCS price discount. As the seventh biggest producer globally, efforts are being made to find alternative transportation mechanisms.

- Increased accessibility to global markets could increase the demand of WCS. Other heavy sour crudes, like the Maya (Mexico) blend (Alberta Government, 2013), currently trade at a premium to the WTI.

FAQs

Why CCI™ matters?

The CCI™ gives investors a tool to better understand Canadian Crude Oil price. Prior to this it was almost impossible for a retail investor to get this type of transparency.

What CCI™ can be used for?

- The CCI™ was created to provide a benchmark for Canadian Oil and provide a reference price for products that enable investors to access this market.

- To gain exposure to Canadian Crude oil without the market risks of buying specific resource equities (oil stocks).

- To speculate on the differential between Canadian Crude and WTI. With changes in transportation, greater transparency and a new benchmark, Canadian crude could end up trading at a premium.

- The CCI™ can be licensed to create third party products or benchmarks.